How to Automate Your Bank’s Loan Participations

Loan participations can present new opportunities for your bank and simultaneously reduce risk. Although there are a number of obvious benefits associated with participation loans, it can be challenging to track annual documents and downstream communication. Our customers have been asking for a better way to share documents and information with participant banks. In response to this request, we’re very excited to announce our loan participation module for AccuAccount. In this post, we’ll show you how our loan participation software simplifies your document management process.

How AccuAccount Streamlines Loan Participations

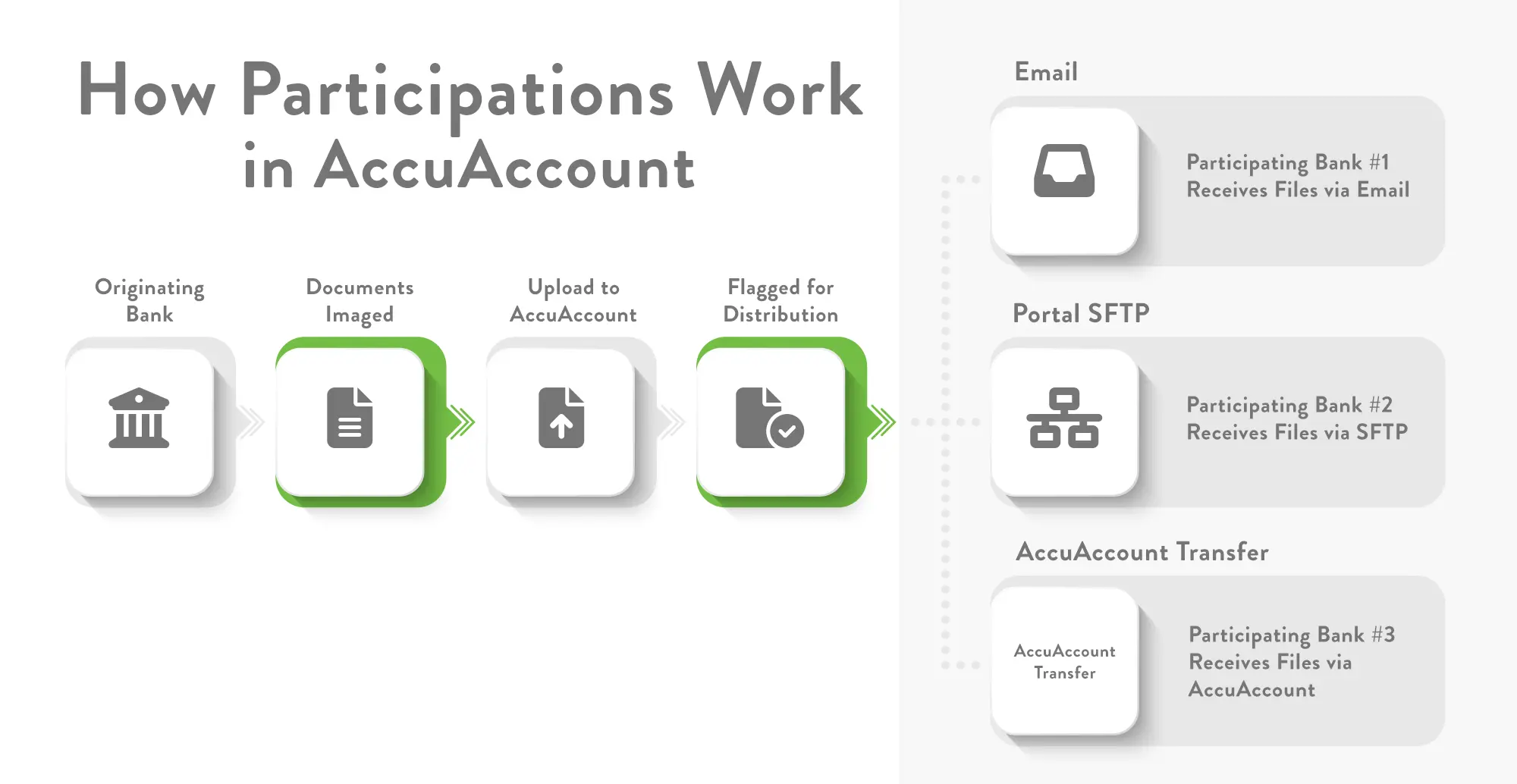

Traditionally, managing the flow of customer documents to downstream partners seemed impossible. Each year, new tax returns, financials, and other documents flow into your bank. To get them downstream to your participating banks, you must scan and securely distribute them manually. AccuAccount simplifies the process. When new documents become available, your downstream participants are instantly notified via email, portal (FTP), or AccuAcount transfer. No action required by your team. The following diagram pretty much says it all.

Adding Participant Banks

It’s easy to connect participating banks to an account or loan with the loan participation module. After the participant bank and contact information is set up by an administrator, you’ll be able to use the dropdown menu in the “Participating Banks” tab to add the relevant banks and contacts to the account. You’ll also be able to include the participation percentage. This feature also gives you the ability to add multiple participants.

Automatic Document Sharing with Downstream Banks

As account documents are added or modified, they’ll be queued to be transferred to loan participants. You can set parameters for how often this process runs. Your electronic copies of documents and notifications will be available for loan participants to view and save.

You also have the option to select items you don’t want to send to participant banks. An example of this might be internal correspondence. You can also put customers on hold if needed. Once the hold is released, the documents will be available to be sent to participants. If there is an issue with an account, you may flag the customer or account to have the entire document sent again.

Understanding the Document Sharing Options

There are three options for sharing files with participant banks: AccuAccount-to-AccuAccount transfer, FTP portal, and email. If both financial institutions use AccuAccount, documents are posted to the existing databases. A notification panel provides notification to the downstream participant, showing which files were sent through the participation system. Banks using the portal option will transmit their documents via a secure FTP portal. Loan participants will receive a notification to retrieve their documents via a link requiring a username and password to access the files. File sharing by email includes an attachment to the documents.

Simplify Loan Participations

Share document updates and other important information with participant banks with ease. Click here to learn more about the loan participation module today!