BUILT FOR COMMERCIAL LENDING:

32,000+ Bankers Use AccuAccount

Simplify loan administration and document management with our core-integrated software, AccuAccount.

Request a demo to learn about:

- Collateral and loan imaging

- Exception tracking and reporting

- Notices, audit prep, and much more

Contact Us for More Information

or to Request Pricing

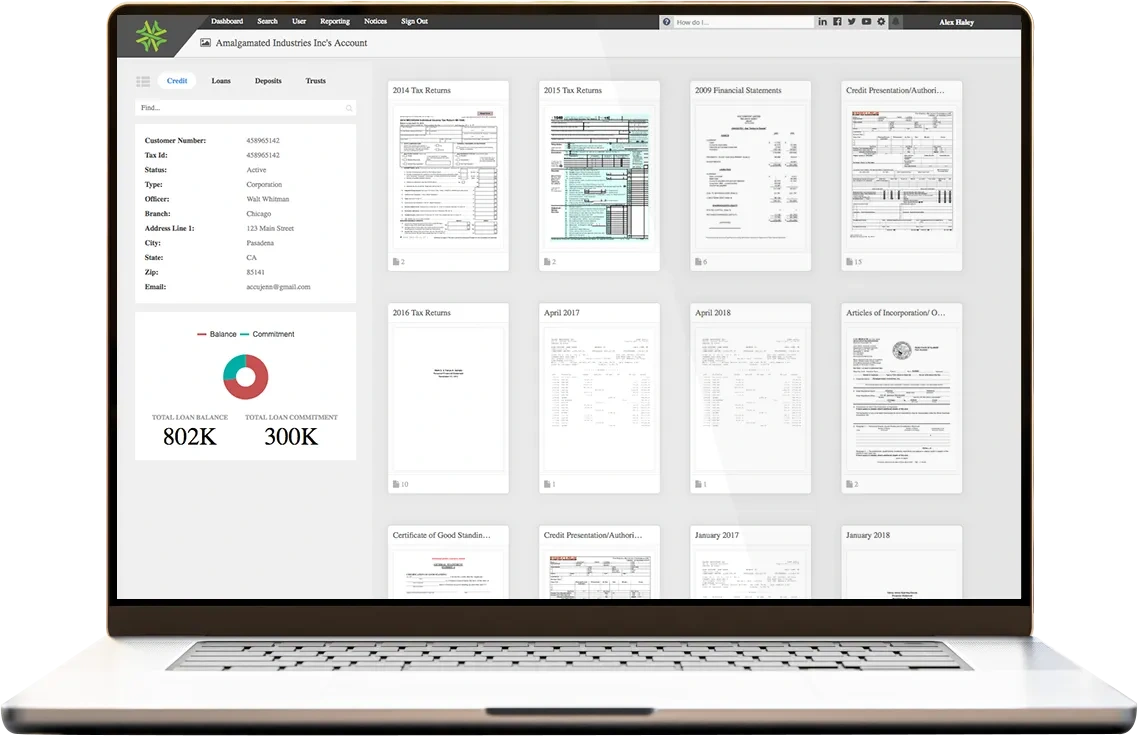

MANAGE CREDIT, LOAN, DEPOSIT, & TRUST DOCUMENTS

Organize your documents, exceptions, and relationships in a single source of truth that integrates to 30+ cores and loan origination systems. Flexible imaging (barcodes, single scan, upload, ePrint, and drag and drop) is one big reason why AccuAccount is the easiest way to collect and organize your bank's or credit union's documents.

FIND, VIEW, & SHARE DOCUMENTS WITH JUST A FEW CLICKS

Elevate customer service with a single source of truth for all of your customer data. Customer documents, loan balances, contact information, exceptions, linked accounts, collateral, and related entities are just a click away.

CLEAR EXCEPTIONS AS YOU IMAGE IN NEW DOCUMENTS

Integrate exception tracking with your imaging to clear exceptions faster and with less effort. Automated exception reporting keeps lenders, senior management, and loan admins informed without manually pulling data files or merging outdated spreadsheets. Put exception management on autopilot.

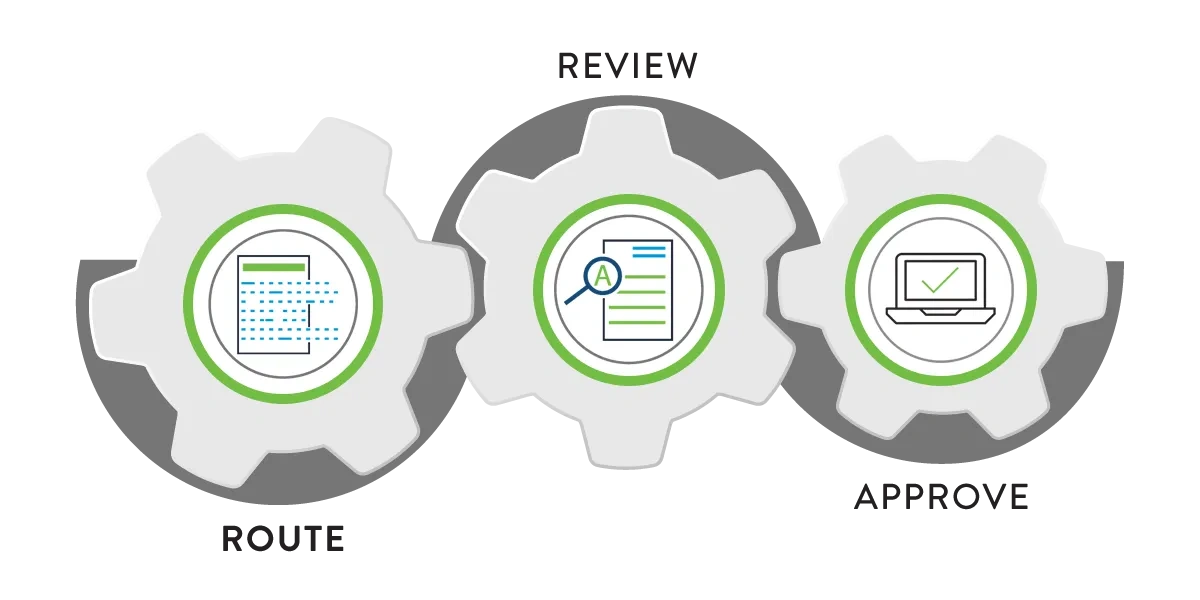

ROUTE, REVIEW, & APPROVE LOAN DOCUMENTS

Accelerate the lending process by integrating a paperless workflow with AccuAccount. Start your applications directly in AccuAccount and add credit documents immediately. Empower lenders and other users with an automated loan review and approval process and transparent pipeline reporting.

AUTOMATE NOTICES, REPORTING, AUDIT PREP, & MORE

Simplify notice letters with built-in mail merge and email capabilities. Prepare for audits and exams in five minutes instead of five days. Automate the distribution of participation documents to downstream banks. Turbocharge your bank's efficiency while eliminating oversights.

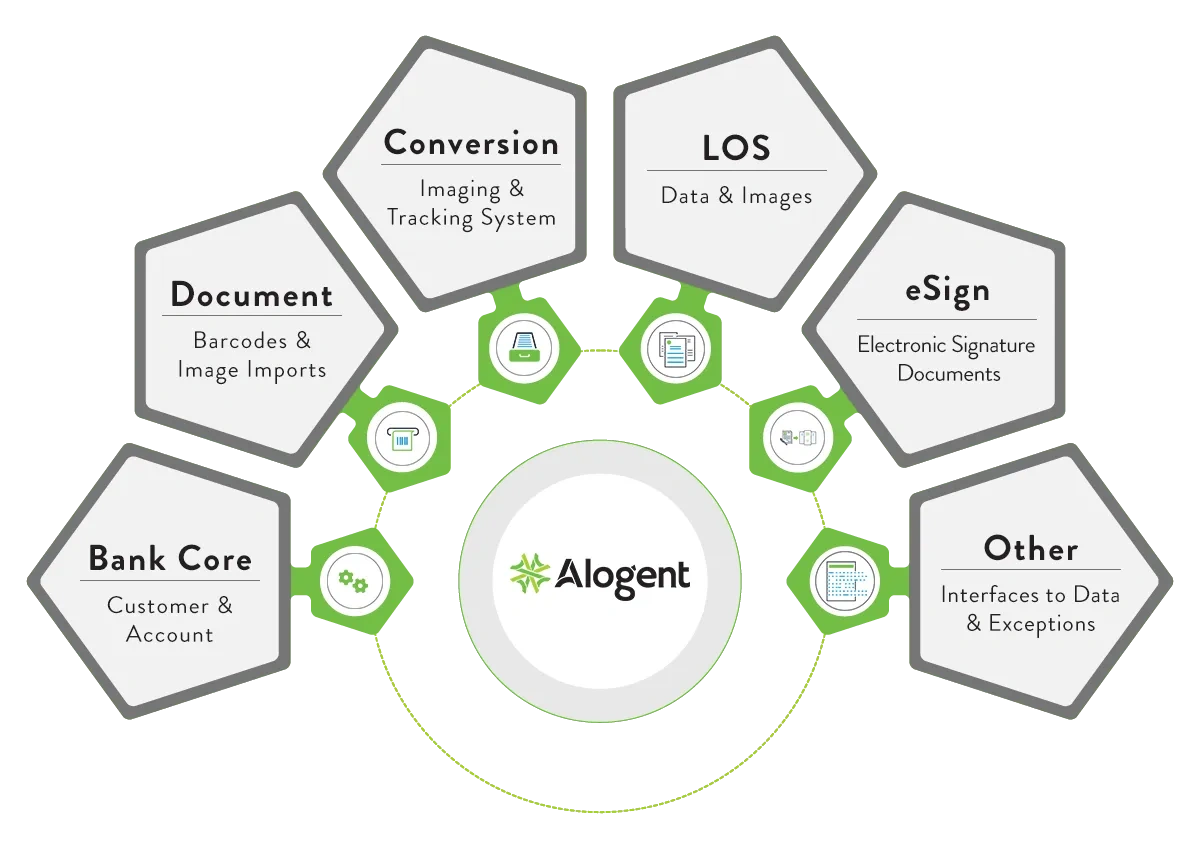

CONNECTS TO 30+ CORES, LOS, & OTHER BANKING SYSTEMS

Bypass manual data entry by integrating AccuAccount to all of your existing banking systems. Push data from your core automatically without creating duplicate records or bad data.

PAPERLESS WORKFLOWS FOR THE LENDING PROCESS

Go beyond basic imaging with workflows that support the entire life of the loan. From paperless loan routing and approval to automated document sharing and email notices, AccuAccount helps teams get more done in less time.

Additional AccuAccount Resources

Take the Next Step

From quality control to participations to audit and exam prep, we've only scratched the surface of what AccuAccount can do for your financial institution. Watch a pre-recorded webinar, download a whitepaper, or check out our FAQs to learn more about our software.

No Registration Required

Watch a 30-minute pre-recorded webinar about Gaining Tangible Efficiencies with AccuAccount

No Registration Required:

The Benefits of AccuAccount for Loan Administrators

No Registration Required:

Senior Lenders, Improving your Lending Process

No Registration Required:

CTS Testimonial

No Registration Required:

Equitable Savings and Loan Testimonial

SEE OUR SOFTWARE IN ACTION

Watch on-demand demos of AccuAccount in our Innovation Hub. Learn how our software integrates to 30+ core systems and loan origination systems, streamlines imaging, and automates exception tracking and audit preparation for 32,000+ bankers.