Alogent Shield+

Next-Level Check Fraud Prevention, Powered by AI and Computer-Vision

For banks and credit unions looking to strengthen their fraud prevention and risk mitigation strategies, Alogent Shield+ delivers advanced protection across every deposit channel and the back office. Built on the trusted foundation of Alogent Shield, Alogent Shield+ leverages advanced artificial intelligence, computer vision, and industry-wide consortium data to combat check fraud across Day 1 and Day 2 workflows—seamlessly integrated with Alogent’s comprehensive item processing solutions.

Always-On Protection

Operating 24x7x365, Alogent Shield+ safeguards all deposit channels and keeps financial institutions one step ahead of fraudsters. Its extensive database of consortium data includes critical information on compromised accounts and known fraud actors, empowering banks and credit unions to make informed decisions and minimize potential losses.

With Alogent Shield+, institutions can confidently protect assets, maintain account holder trust, and deliver a frictionless experience—without sacrificing security.

Real-Time, Day Zero Decisioning and

Cloud-Hosted Consortium Intelligence

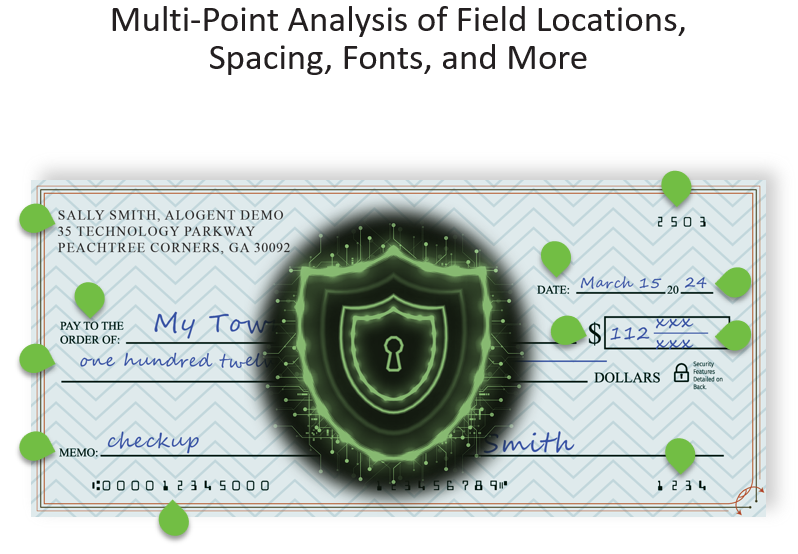

By analyzing checks instantly at the point of capture and before they enter downstream workflows, Alogent Shield+ facilitates Day Zero decisioning to stop fraud early and reduce risk exposure. Examining 24 document attributes in real time, Alogent Shield+ compares checks against existing profiles, streamlines manual reviews, and minimizes false positives. Advanced image analytics and consortium data improve verification efficiency, issue alerts for compromised accounts, and provide actionable insights from dark web sources. With Alogent Shield+, banks and credit unions gain always-on protection across all deposit channels—without adding friction for account holders.

- AI-powered and computer vision fraud detection

- Real-time decisioning

- Access to a cloud-hosted consortium of check profiles and financial institution data

Account Holder Scoring Model

Enhance your risk mitigation strategy with Alogent's real-time image and data validation capabilities. Create comprehensive account holder profiles and a user scoring model based on banking history, deposit habits, OFAC lists, and other business rules to optimize user experiences across all deposit channels. By implementing auto-decisioning, treat transactions the same across both full-service and self-service points of capture, effectively detecting anomalies and mitigating fraud. The outcome: reduced friction for users, lower overhead and manual processing, and improved fraud prevention for your financial institution.

Protect Your Deposit Channels with Alogent Shield+

Transition from identifying risks to actively safeguarding your assets across all in-branch and remote deposit channels, inclearings, and X9 deposit files. Learn more about Alogent Shield+ today.

Alogent Shield+ is powered by Mitek Check Fraud Defender