Streamline Exception Reporting for Your Next Board Meeting

Your board of directors relies on a variety of information to properly assess operational strengths, weaknesses, growth opportunities, and risk exposures. Accurate exception data is crucial, especially when it comes to commercial lending. In fact, the OCC’s Commercial Real Estate Lending booklet specifically mentions “supervisory LTV exceptions” and “policy, credit, and collateral exceptions” among information reviewed by boards. According to the booklet:

The following are examples of information that management and the board typically review related to CRE lending:

- Loan risk ratings

- ALLL or ACL information

- Rating migration

- Concentrations of credit

- Supervisory LTV exceptions

- Delinquent, nonaccrual, nonperforming, and charged-off loans

- Policy, credit, and collateral exceptions

- Risk layering

- Credit risk review conclusions

- Portfolio credit quality measures

- Loan workout measures

—From Commercial Real Estate Lending published by the Office of the Comptroller of the Currency

Does your bank or credit union have an efficient and effective workflow for tracking, organizing, and reporting exception data? Let’s explore how Alogent’s ECM software, AccuAccount, can simplify this workflow.

Preparing Exception Reports for the Board Isn’t Easy

Financial institutions often struggle to prepare timely, accurate exception reports due to:

Decentralized exception management: Banks and credit unions with multiple locations sometimes opt for a decentralized approach, delegating oversight to each branch, department, or user. As a result, exception data resides in numerous locations and file formats.

Multiple tracking systems: Few banking systems offer comprehensive exception tracking across loans, credit, policies, and tasks. Spreadsheets are a common solution for exception management, as are core-provided modules and certain LOS (loan origination systems) platforms. Unfortunately, each system organizes information differently and must be integrated together for board reporting.

Manual report preparation: Merging data from multiple ticklers, spreadsheets, and exports can require hours of tedious effort for administrative teams. In addition, manual data manipulation opens the door to oversights, ultimately making it harder for the board to identify pressing matters.

Simplify Board Reporting with AccuAccount

Using AccuAccount solves many of the traditional challenges of exception reporting. In addition to centralized policy and document exception management, AccuAccount offers advanced capabilities for enhanced reporting.

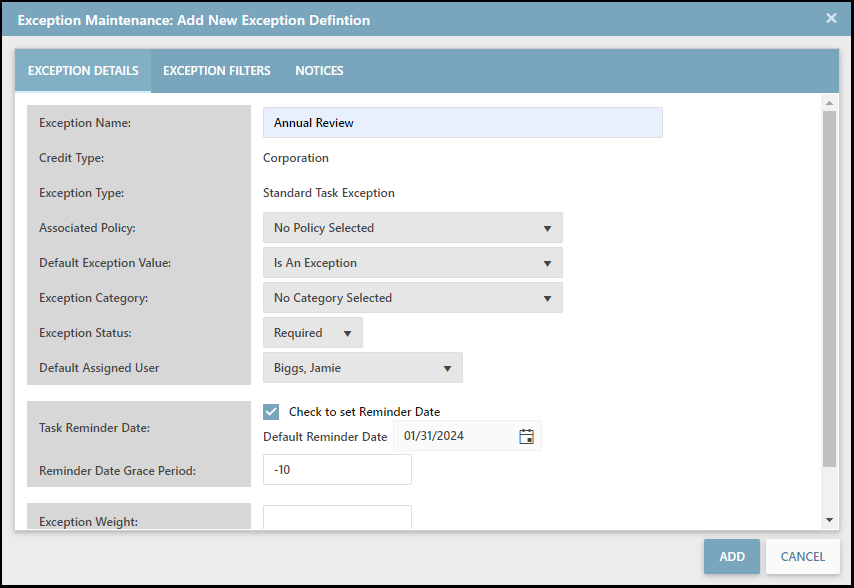

Task exceptions create accountability for one-off situations—such as remembering to complete annual reviews on ag loans—without handwritten to-do lists.

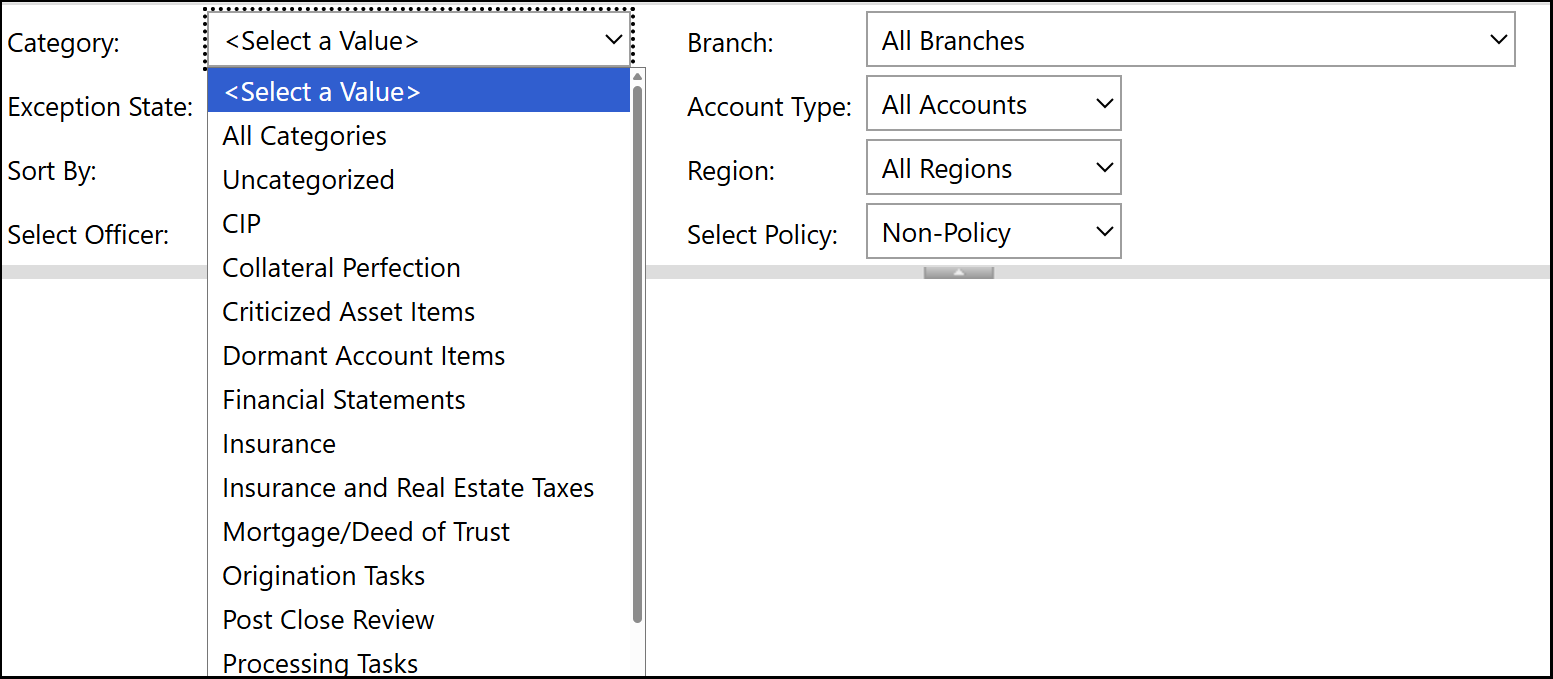

Categories can be assigned to exceptions and incorporated into reports that surface high-priority issues to the board.

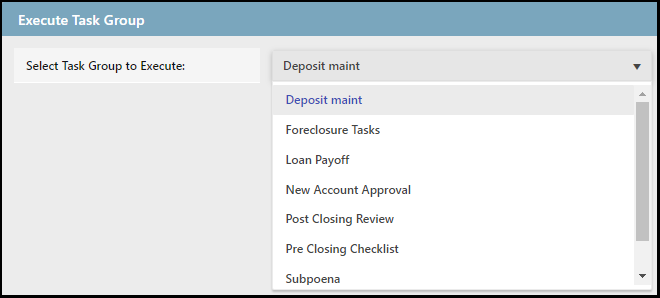

Assigning categorized tasks within a task group accelerates delegation while increasing transparency for board reporting.

Importing data into flex fields in AccuAccount unlocks information that would otherwise reside in the core, LOS, or another system. Combining exception data with other relevant information, such as ALLL, ACL, and risk ratings, further streamlines reporting.

Learn more about AccuAccount or contact us to schedule a software demo.

watch on demand: track exceptions for loan administrators

Download: Free Exception Tracking Cost Calculator

Contact us for pricing or a demo

Be the first to know! Click below to follow us on LinkedIn for news and content updates!