[Playbook] Optimizing Branch & Teller Capture with Real-Time Processing in Unify

Here’s the Situation: Teller line transactions are fast-paced and high-stakes. Financial institutions must provide frontline staff with tools that reduce depositor wait times and enforce business rules in real-time to minimize risk. Unify, Alogent’s deposit automation platform, enables this by combining a streamlined user interface with back-end validation logic that helps ensure efficient, compliant, and accurate check deposit workflows. Institutions can leverage Alogent’s full-service UI or integrate directly with Unify’s API to allow for a seamless teller experience within existing core or teller systems.

Here’s how it works in action:

Play #1: Teller Check Deposit Capture

Game Plan

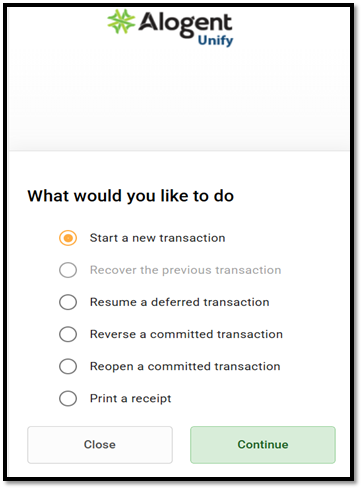

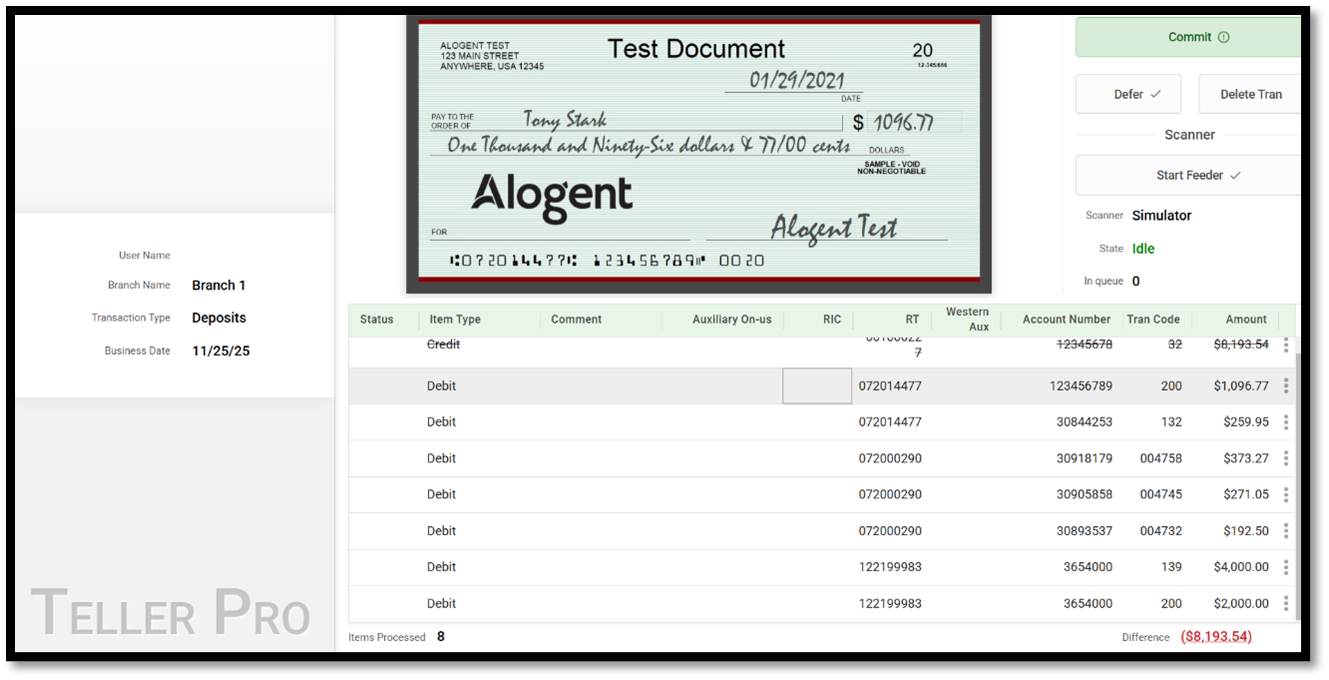

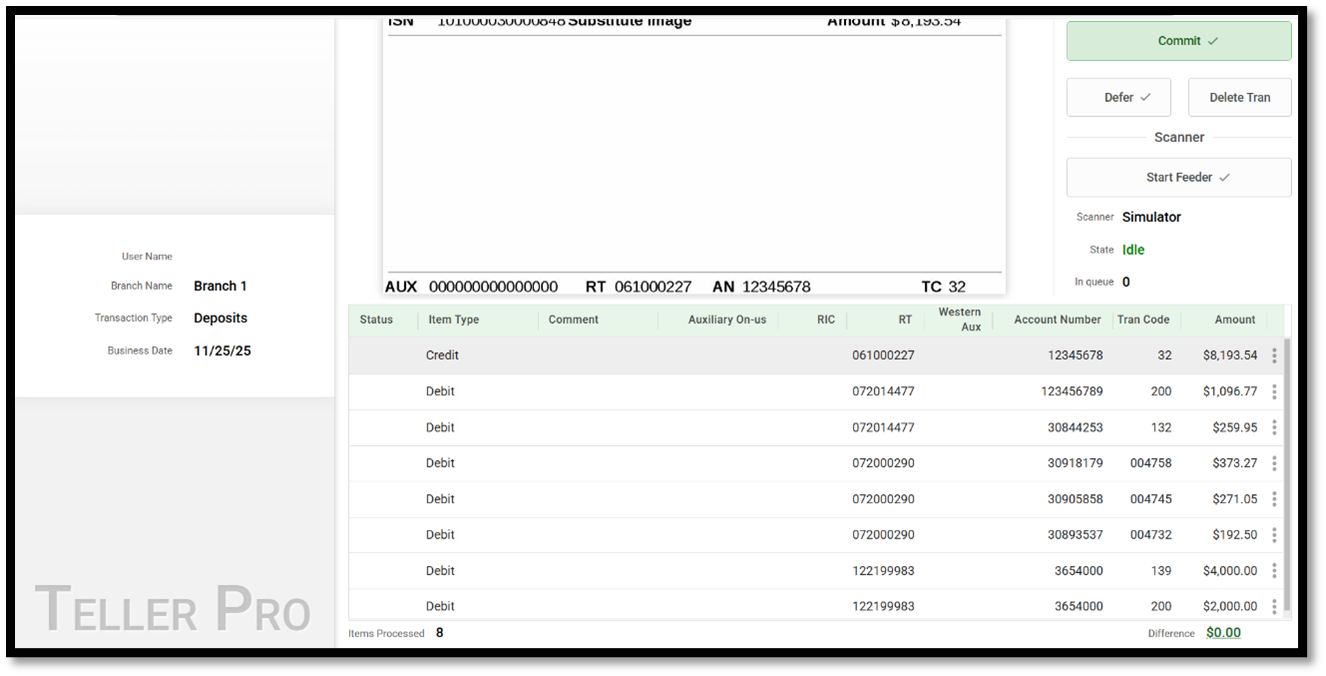

Step 1: The teller logs into their teller system and locates the depositor’s account. Once the capture process is initiated, the system launches Unify. As each check is scanned, the captured images appear in real-time within the session grid.

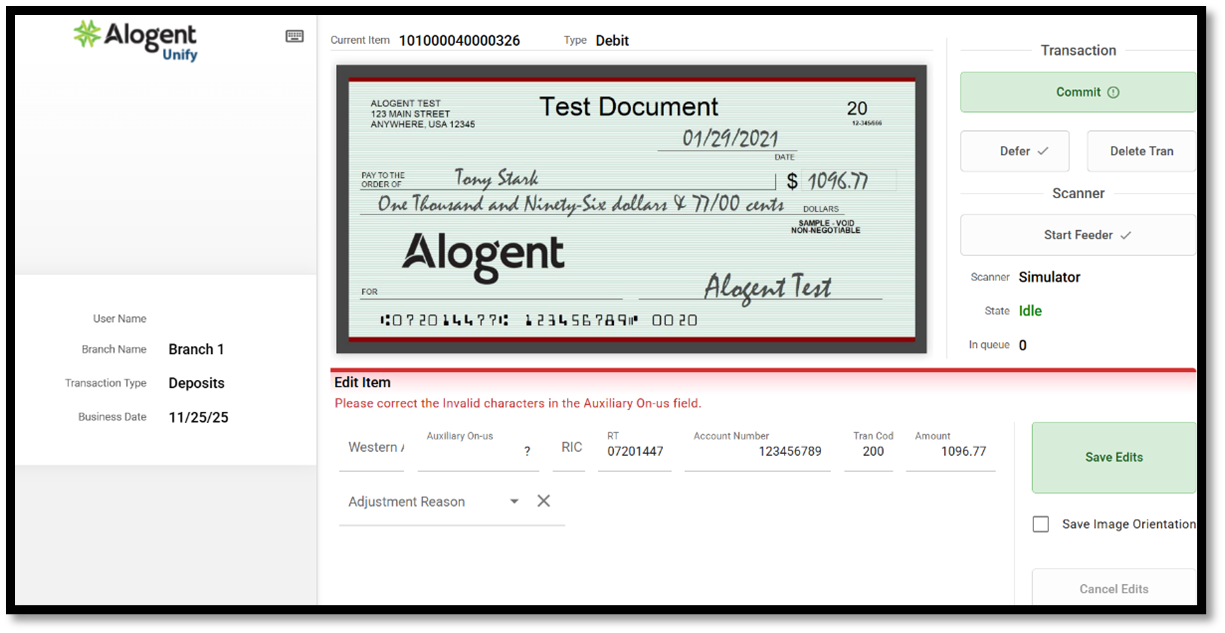

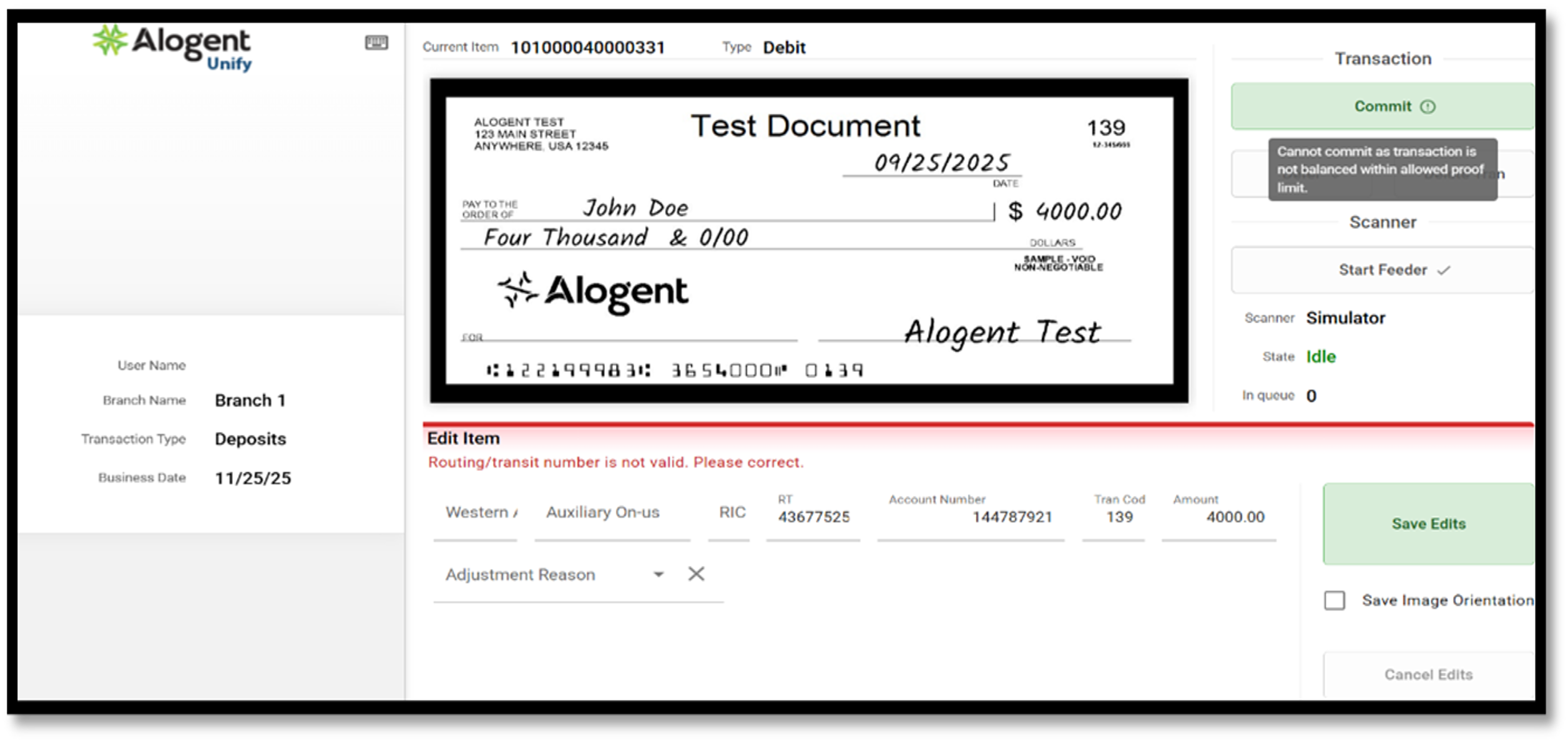

Step 2: Once each check image is captured and processed, Unify validates the item’s negotiability and compliance. This includes checking codeline field values against the institution’s configured business rules engine. Examples of potential exceptions include:

- Illegible or unreadable characters

- Incomplete or invalid routing numbers

- Missing amounts or check numbers

- Partial or malformed account information

Step 3: Scanned items are validated through configured Image Quality (IQA) and Usability (IUA) assessments. During this step, Unify’s built-in fraud analysis tool evaluates the item against configured institutional risk parameters, and real-time calls are made to additional third-party tools if enabled.

Step 4: Items that fail business rule validation, such as invalid characters in the codeline, duplicate images, image quality or usability issues, or exceptions returned from fraud and account lookup services, are flagged for teller review.

Note: The teller cannot complete the session until all exceptions are resolved.

Step 5: Once all checks pass validation checks, the teller submits the items for posting to the core system. Transactions are committed to the Unify database to begin the clearing process.

Note: Delays caused by traditional batch posting and routing of on-us checks in outgoing cash letters can be eliminated. Additionally, on-us items can be identified and posted in real-time.

Play #2 – Balancing and Reconciliation

At the end of the day, each teller is responsible for reconciling all end-of-day balancing. Unify supports this by providing full visibility into daily transaction totals.

Game Plan

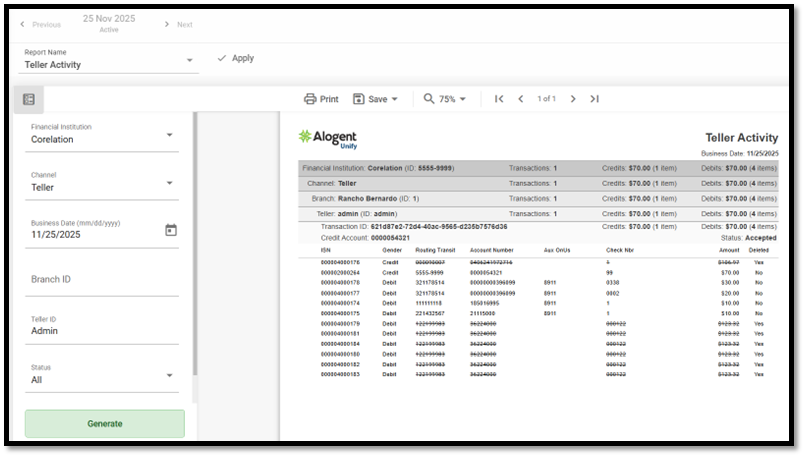

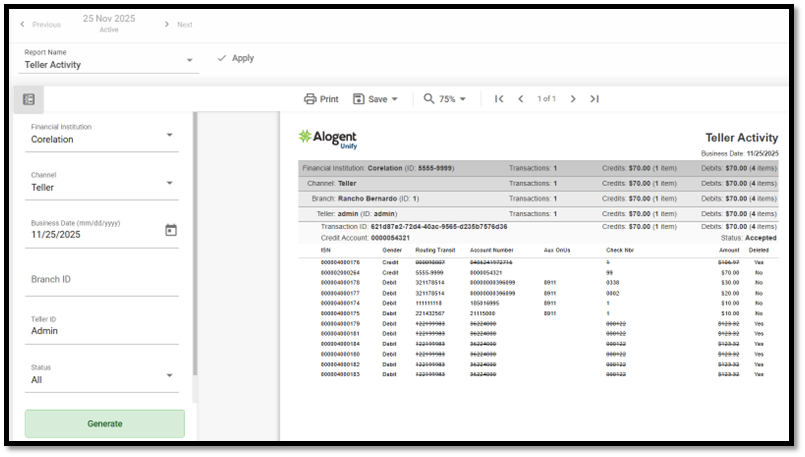

Step 1: The Unify API provides detailed information on all checks captured and processed for the day at the following levels:

- Financial Institution

- Branch

- Teller

This data is sent to the calling application, enabling the teller interface to display it in real-time. It is also accessible through the Unify portal within the Teller Activity and Summary reports.

Teller Activity Report

Teller Summary Report

Step 2: Tellers, supervisors, and accounting teams can use this information to reconcile against core system totals, ensuring all daily activity aligns across systems.

Explore More: Unify and the Future of Branch & Teller Capture

Looking to streamline your teller line operations while reducing fraud risk and improving efficiency? Unify, Alogent’s award winning enterprise deposit automation platform, streamlines deposit capture across all channels, including in-branch capture, remote deposit, and back-office efficiency. With real-time validation, configurable business rules, and seamless integration to your core, Unify empowers frontline staff to process transactions with speed and accuracy, while reducing the burden of manual review across your entire institution.

Webinar: Transforming Teller Capture

Blog: Bank Teller’s Guide to Stop Fraud at the Front Counter

Be the first to know! Click below to follow us on LinkedIn for news and content updates!