8 Benefits of AccuApproval for Financial Institutions

Need an efficient way to electronically route and approve commercial loan applications? Look no further than AccuApproval, Alogent’s loan approval solution for AccuAccount. With AccuApproval, banks and credit unions can reduce reliance on paper routing sheets while increasing visibility and control.

Is AccuApproval the right tool for your financial institution? Here are eight reasons to consider implementing it in tandem with AccuAccount.

1. Budget-Friendly Alternative to LOS

Loan origination system (LOS) technology can be cost prohibitive, especially for smaller financial institutions with limited IT budgets. User licensing, implementation fees, and ongoing support contracts quickly erode return on investment. By contrast, AccuApproval is included as a standard feature with our AccuAccount Enterprise plan. Enterprise customers enjoy electronic routing and approval in AccuAccount—without budgeting for and procuring additional software.

2. Early Capture

Banks and credit unions often wait until after booking to image their commercial loan documents. However, imaging sooner (rather than later) can unlock incremental efficiencies and mitigate risk of missing documents. Utilizing a solution like AccuApproval makes early capture feasible without burdensome administrative headaches.

3. Reduced Complexity

Consolidating commercial loan approval and early capture under one roof reduces unnecessary integrations. Technical and operations staff have fewer systems to learn and maintain, which saves time and minimizes frustration. Converting an application into an approved loan, for example, requires just a few clicks with AccuApproval. Application histories and previously captured documents automatically appear in the approved loan file in AccuAccount—without APIs or copy/paste!

4. Flexibility for Your Lending Process

Commercial lending workflows can be complex and require multiple levels of decision-making. Case in point, according to the 2024 FDIC Small Business Lending Survey, approximately 47% of small banks reserve signature authority for loans of $1 million to the third (or higher) level of loan approval. AccuApproval is adaptable to accommodate a variety of scenarios, including lending limits and departmental routing requirements.

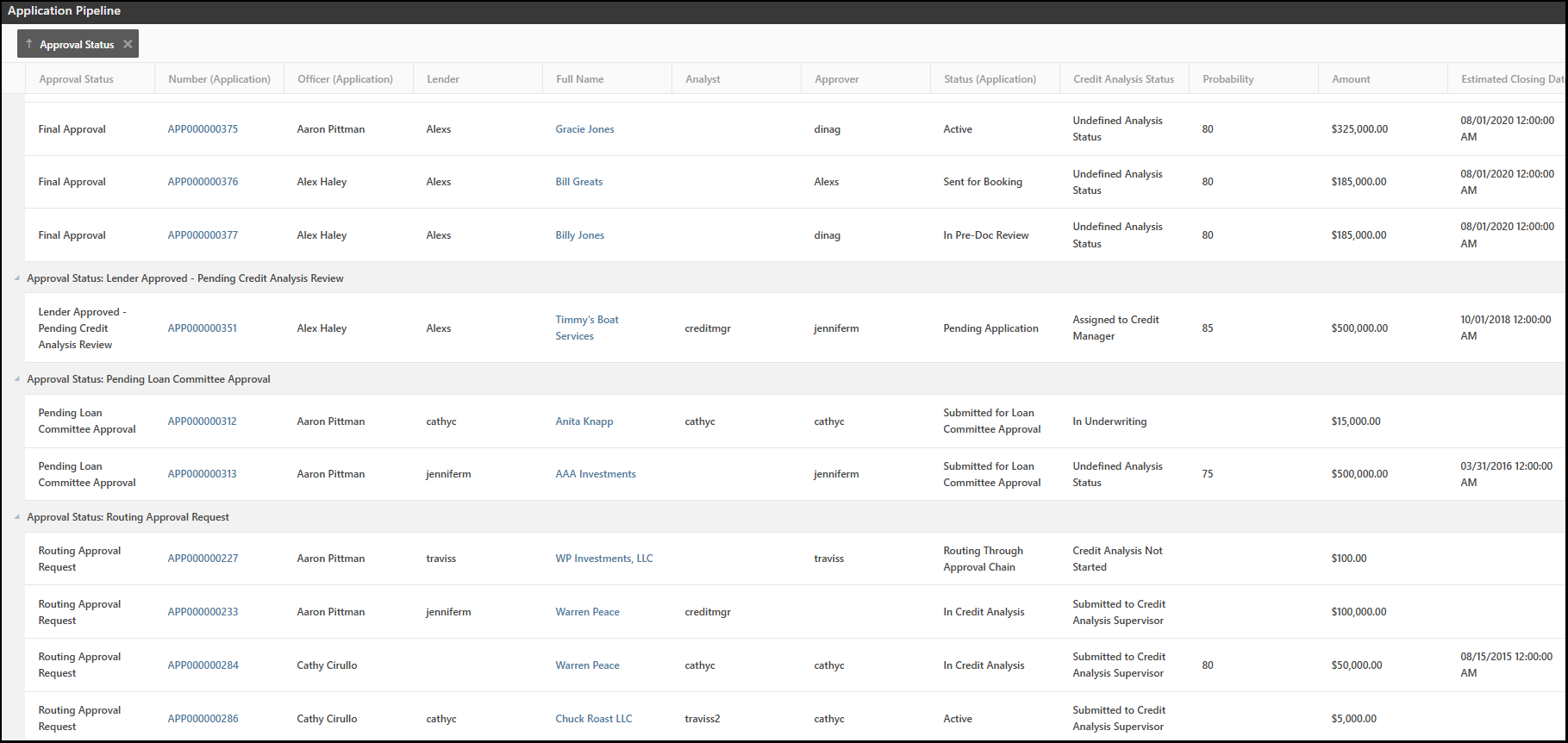

5. Pipeline Visibility

For some financial institutions, tracking commercial loan opportunities involves considerable data manipulation in spreadsheets. Such reports become unreliable soon after they are prepared, as a loan’s stage can change at practically any moment. Tracking loan applications with AccuApproval streamlines pipeline reporting, especially when used with Dynamic Reporting for AccuAccount. Build, view, and share loan pipeline reports to gain a live view of in-process opportunities (no spreadsheets required)

6. Enhanced Customer and Member Experiences

Organizing customer and member documentation in AccuAccount makes it easier to enable person-centric lending experiences. In a matter of seconds, commercial lenders can easily search for, find, and view credit, loan, and collateral information for existing borrowers. Data from the core is also visible in AccuAccount, providing a comprehensive view of each relationship. Then, using AccuApproval, the lender can initiate an electronic loan application without pen and paper.

7. Streamlined Ability to Relend to Existing Borrowers

Being able to quickly add additional loan applications into the system benefits the financial institution, too. Unlike paper applications that are easily forgotten, lost, or misplaced, AccuApproval delivers a number of accountability features (timers, automated emails, etc.) to ensure the lending process stays on track.

8. Intuitive Setup with Self-Guided Templates and Videos

We’ve built AccuApproval to include a self-guided setup process with helpful templates and training videos. Whether you require a simple implementation or a more advanced workflow, your in-house team should be able to launch AccuApproval in a reasonable amount of time.

Visit our product overview page to learn about AccuApproval. Contact us to schedule a personalized software demo for your financial institution.

Be the first to know! Click below to follow us on LinkedIn for news and content updates!