Why Banks and Credit Unions Need Robust ECM Solutions to Boost Security, Compliance, and Operational Efficiency

In the financial services industry, security is far more than a buzzword–it is the cornerstone of trust. Banks and credit unions operate under stringent regulatory requirements, entrusted with protecting not only the sensitive information of account holders but also the data concerning employees and organizational operations. Despite significant strides toward digitalization, financial institutions continue to handle a considerable volume of paper. Regulatory mandates determine how long critical documents, such as loan records, must be retained, while enduring customer behaviors help keep paper in circulation. In light of these factors, how confident are you in the security of the data managed by your institution?

Overcoming Content Management Challenges: Why Paper and Basic Digital Systems Fall Short

Many banks and credit unions rely on a variety of systems and processes to manage their enterprise content. These strategies often involve a mix of paper storage, such as on-site file cabinets and off-site storage facilities, along with digital solutions like shared network drives. Does this align with your financial institution’s current content management practices?

The primary issue with paper-based content management is its inherent vulnerability. Without a clear way to track document access or monitor changes, sensitive information is at risk. Unlocked or even locked filing cabinets expose critical documents to potential loss, damage, or theft. In addition, digital storage systems like shared network drives lack the necessary security features—such as configurable permissions, control settings, and audit trails—to protect sensitive data. These drives typically offer broad access, making it difficult to limit data access to only those who need it.

For banks and credit unions, these inefficiencies create significant risks, including data breaches, compliance violations, and operational delays. Without an effective enterprise content management (ECM) solution, your institution may struggle with both safeguarding sensitive information and maintaining operational efficiency. Adopting a robust ECM system specifically designed for financial institutions can streamline document storage, improve security, and enhance productivity. By centralizing and securing both digital and physical records, ECM solutions help ensure compliance while making it easier for employees to quickly find and retrieve the data they need.

Is your institution ready to modernize its content management strategy?

The ECM Advantage: Enhance Security, Efficiency, and Compliance for Banks and Credit Unions

In contrast, a robust enterprise content management platform offers a powerful, centralized solution that overcomes the limitations of paper-based and basic digital document management systems. Here’s how ECM can transform your bank or credit union’s content management strategy:

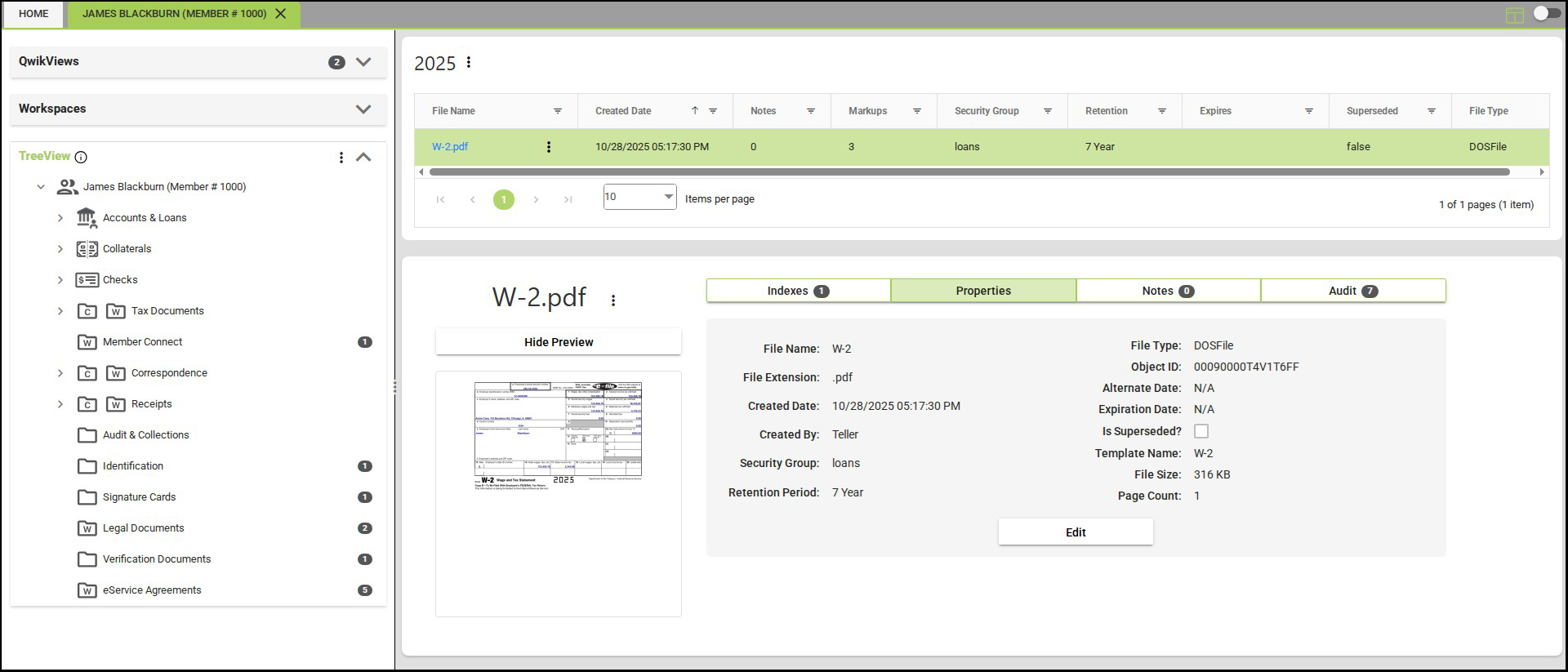

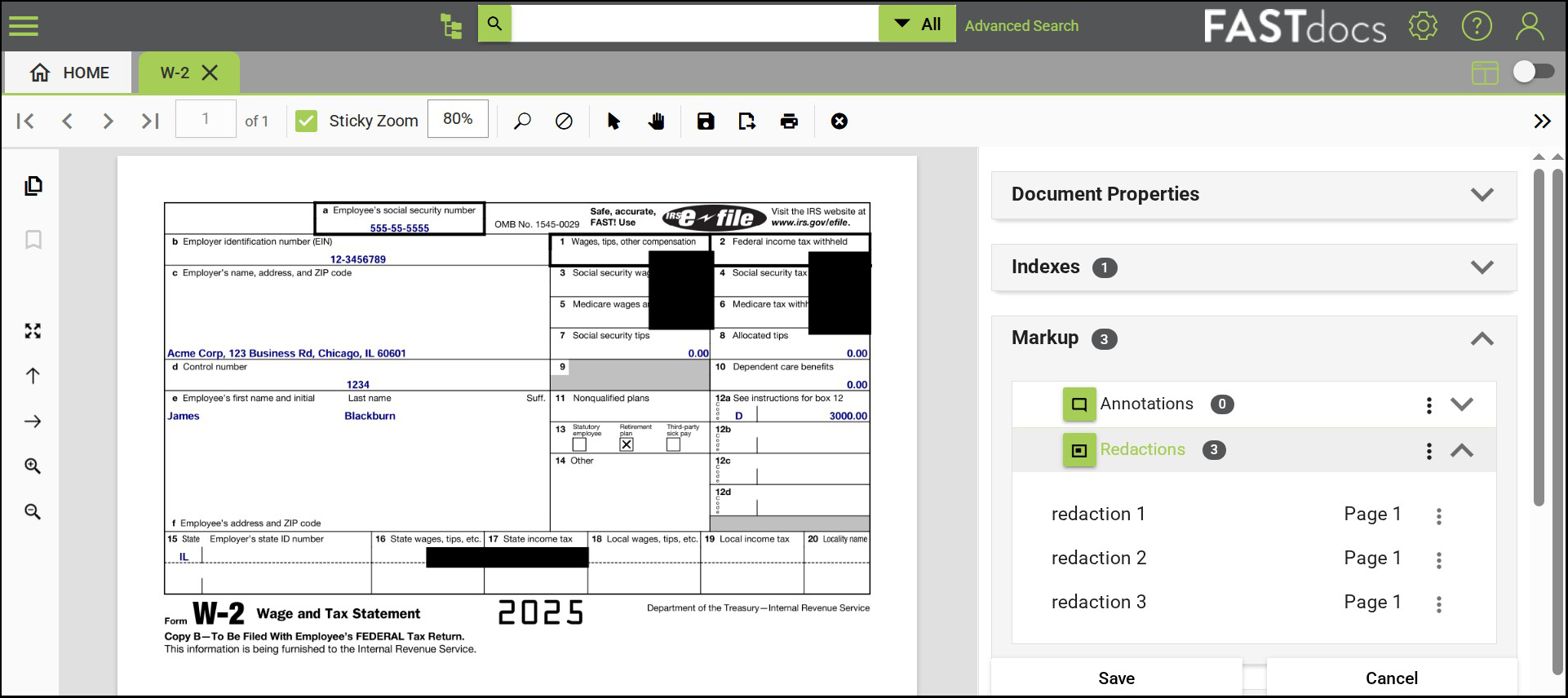

- Access Controls: An ECM platform provides configurable user permissions, ensuring that only authorized users can view, edit, or download sensitive data based on their role or department. With Alogent’s ECM suite, financial institutions can take access control to the next level, configuring permissions not only by user role but also by document type, module, or even specific fields within a document. This fine-grained control helps ensure that sensitive information is restricted to the right individuals and changes are carefully monitored.

- Secure Data Storage: ECM platforms offer scalability and a centralized repository to store documents and imaged files securely. This consolidation minimizes the risks of loss or unauthorized access associated with managing multiple applications and storage systems. In addition, ECM solutions reduce data duplication, expedite document access and retrieval, and enhance overall efficiency. This ensures that staff can quickly access the necessary documents, leading to better service for account holders and improved operational productivity.

- Streamlined Workflows: With ECM, banks and credit unions can automate and configure workflows to route documents for review and approval, reducing the reliance on manual processes. This streamlining enhances overall efficiency, minimizes human error, and ensures that sensitive information is only accessible to those who are authorized to handle it. By automating key processes, an ECM solution helps institutions maintain compliance and improve service delivery to customers.

Adopting an ECM platform tailored to the needs of financial institutions enables your bank or credit union to securely manage documents, improve workflows, and maintain regulatory compliance while enhancing productivity.

Take the Next Step Toward Greater Information Security. Discover How Alogent’s ECM Suite Enhances Efficiency and Compliance for Banks and Credit Unions

In an era where data breaches are becoming increasingly common, the need for robust information management has never been more critical. Alogent’s ECM suite is specifically designed to meet the unique information management needs of banks and credit unions. Packed with features to manage documents and information throughout their lifecycle, our suite provides a comprehensive security framework that ensures seamless user authentication and governs rights and access to sensitive data within the platform.

Join our ECM experts for a 30-minute webinar on-demand, where they dive into the powerful features of our ECM suite and demonstrate how it helps eliminate risky, paper-heavy processes. Learn how Alogent’s solution improves efficiency, enhances compliance, and streamlines workflows for banks and credit unions, empowering institutions to better safeguard data while optimizing operations.

Dodd-Frank SEction 1071: What you need to know

Learn more about Alogent's ECM Suite

Be the first to know! Click below to follow us on LinkedIn for news and content updates!