[Playbook] Real-Time Transaction Posting in the Core with Unify

Here’s the Situation: Financial institutions are increasingly expected to post transactions in real-time to meet evolving account holder expectations. Traditional batch posting methods are not designed to support this level of immediacy, often resulting in delays between deposit initiation and account updates. By integrating with the core platform via web services, Unify enables financial institutions to post on a transaction level. Here’s how it works in action:

Play #1 – Mobile Deposit Initiated by an Account Holder

An account holder initiates a deposit using their mobile banking application. The check is accepted and submitted for processing.

Game Plan

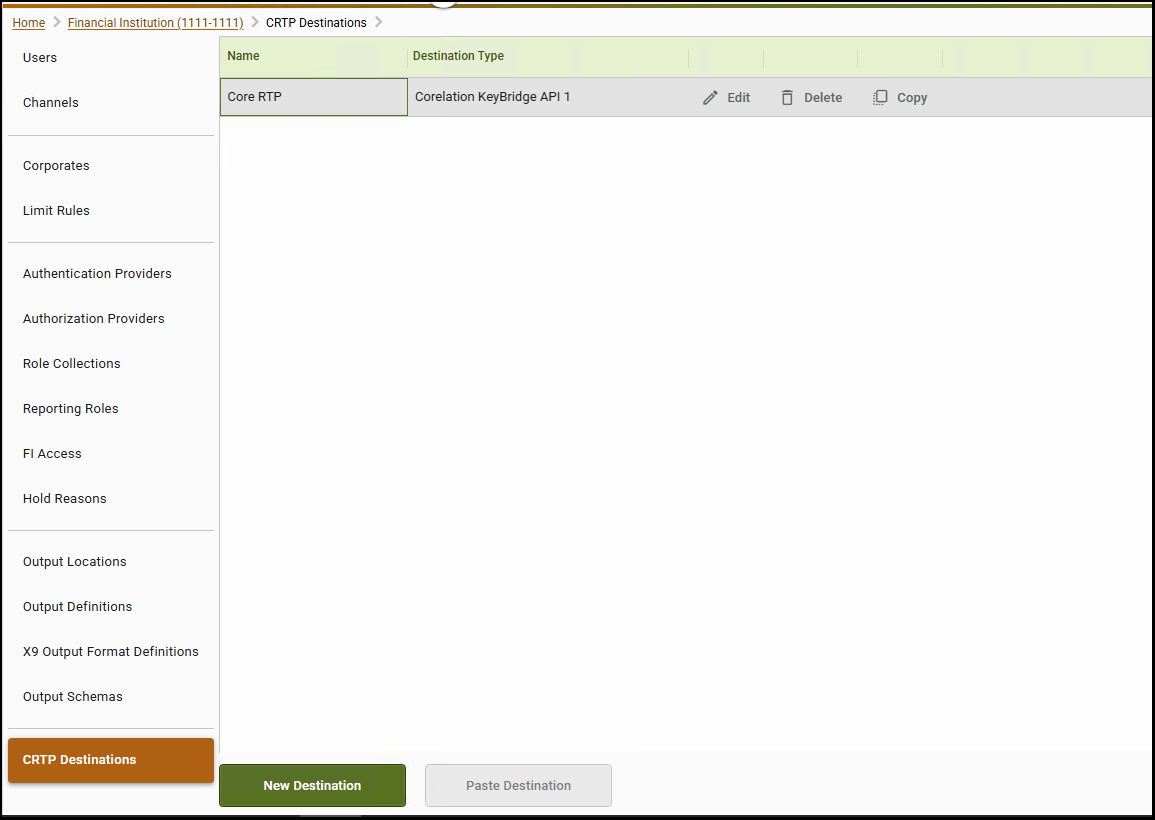

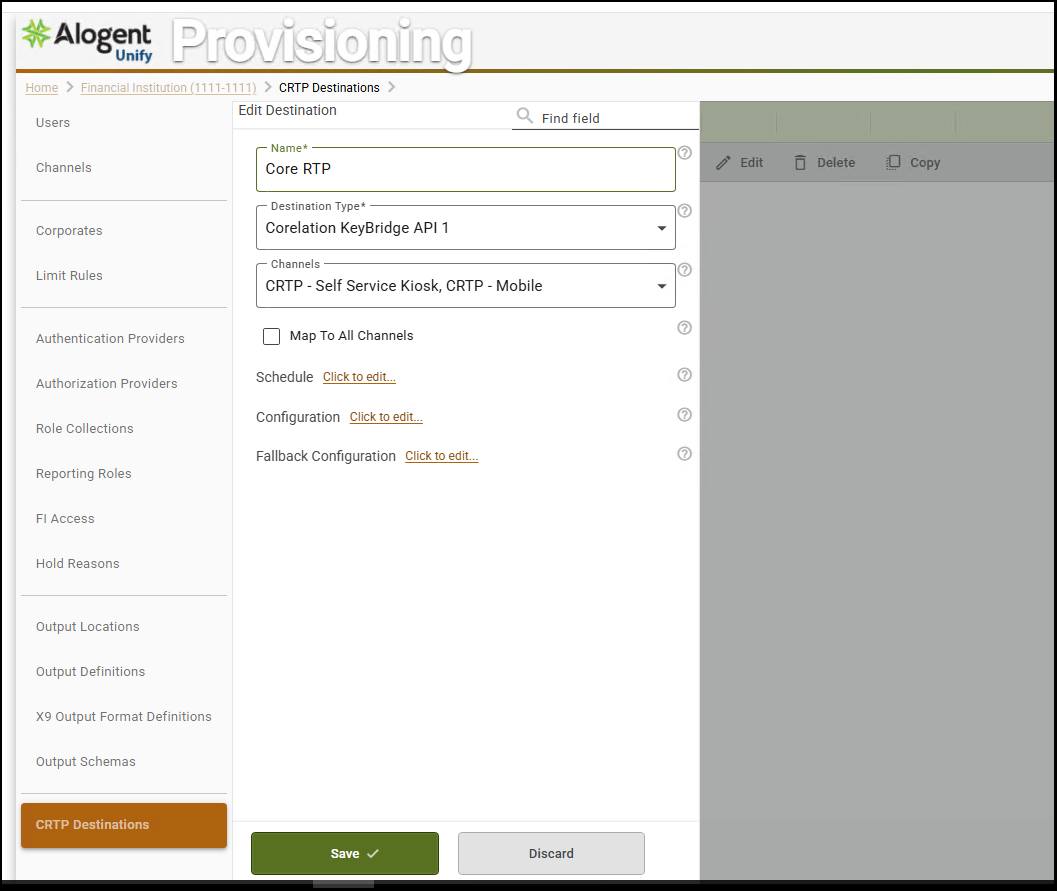

Step 1: Once the deposit is captured, Unify processes the item to validate its negotiability and compliance. Upon reaching the defined balanced status, an API call is triggered to post the transaction to the core system in real-time.

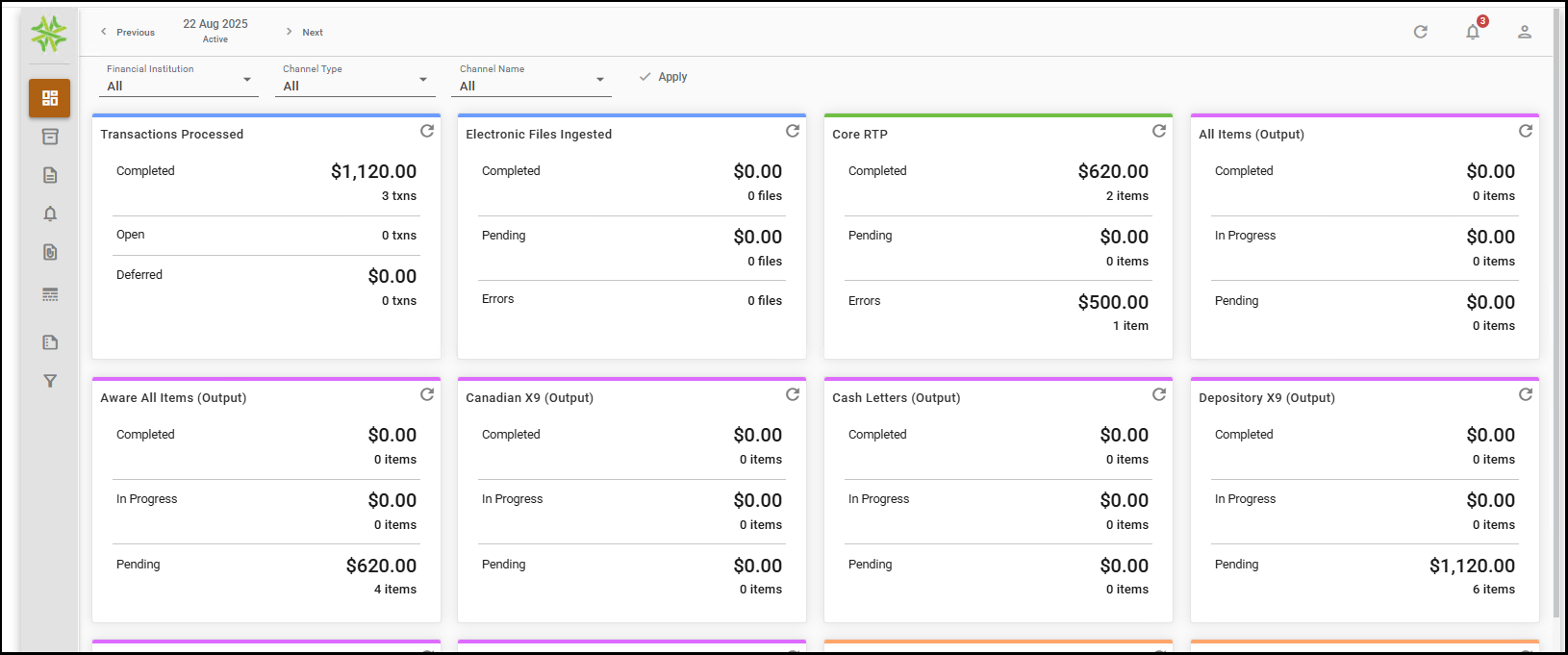

Step 2: The customer or member’s account is updated with the deposit within minutes.

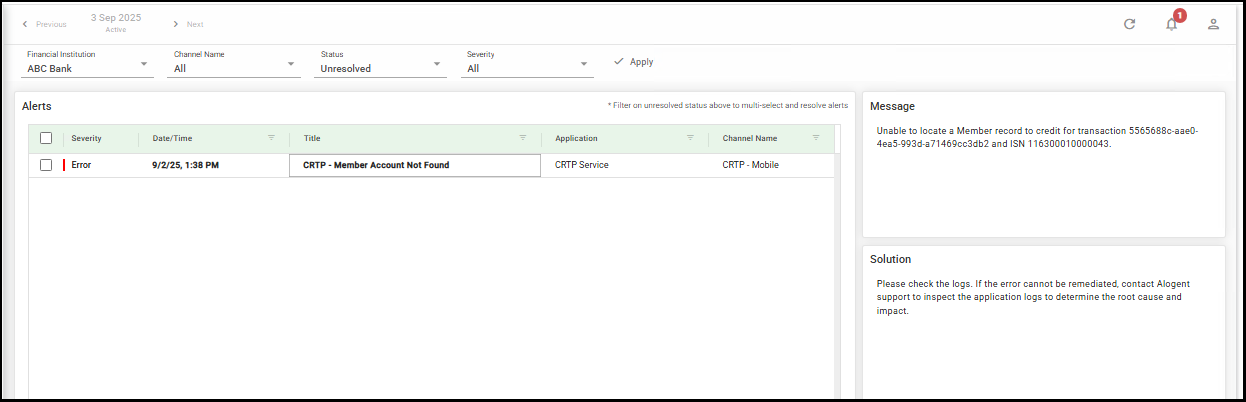

Step 3: In the event of a posting failure or system issue, Unify flags the exception and provides specific operational guidance within the portal. Examples include:

- Core Connectivity Failure: If the endpoint cannot be reached due to a core system issue, the Unify Portal allows the institution to resubmit the posting attempt manually once connectivity is restored.

- Non-Negotiable On-Us Item: If the deposited check is an on-us item that fails negotiability checks (e.g., NSF, uncollected funds, or stop payment), it is routed to the outgoing returns exception queue for further action.

[Note] Throughout the business day, Unify provides continuous visibility into the posting status of each transaction. This real-time data allows operations teams to proactively monitor activity, address exceptions early, and simplify end-of-day balancing and reconciliation.

Step 4: Any failed posting attempt due to system exceptions that continue up to the financial institution's End of Day will result in a Batch Posting File being generated to ensure that posting will still be completed on the same business day that the transactions are acquired.

If a posting failure persists through the institution’s end-of-day processing window, Unify automatically generates a batch posting file. This ensures that all transactions acquired during the business day are posted on the same business day to minimize impact on downstream systems.

Explore More: Unify and the Future of Real-Time Posting

Looking to modernize and streamline your institution’s approach to batch and real-time transaction posting? Download our free eBook to explore how Unify, Alogent’s enterprise deposit automation platform, supports flexible posting options, improves operational efficiency, and aligns with evolving account holder expectations.

Be the first to know! Click below to follow us on LinkedIn for news and content updates!