Modernizing Teller Capture: The Hidden Costs of Legacy Deposit Systems for Banks and Credit Unions

Historically, the teller line has been one of the most trusted points of interaction in banking. Even as digital and self-service channels grow, consumers and businesses continue to rely on in-branch services, especially for high-value deposits and financial advice.

As account holder expectations change and operational pressures grow, outdated technology at the teller line can introduce inefficiencies, delays, and risks. For banks and credit unions, the real question becomes: can your existing teller capture systems keep pace with modern expectations? And even more importantly, what’s the cost of not making a change?

The Strategic Role of Teller Capture in Modernizing Bank and Credit Union Operations

Teller capture doesn’t operate in isolation. Every in-branch deposit sets off a chain of activity across your core system, risk and fraud controls, and back-office operations. Decisions made at the teller line directly affect posting, clearing, reconciliation, reporting, compliance, and overall account holder service.

Relying on legacy, batch-based systems builds what the industry calls technical debt: aging systems, manual workarounds, and limited integrations. These systems were never designed for today’s banking expectations. Over time, this technical debt compounds, slowing innovation, increasing maintenance overhead, and widening security gaps.

The cost of not modernizing teller solutions isn’t abstract – it’s paid daily through operational inefficiencies, rework, and increased risk.

How Real‑Time Processing Improves Teller Capture Efficiency and Risk Controls for Financial Institutions

Real‑time processing and reconciling does more than accelerate transactions; it fundamentally reshapes how institutions manage check deposits. Instead of relying on batch files and downstream reviews, issues are identified and resolved at the point of capture, when they are easiest and least costly to address.

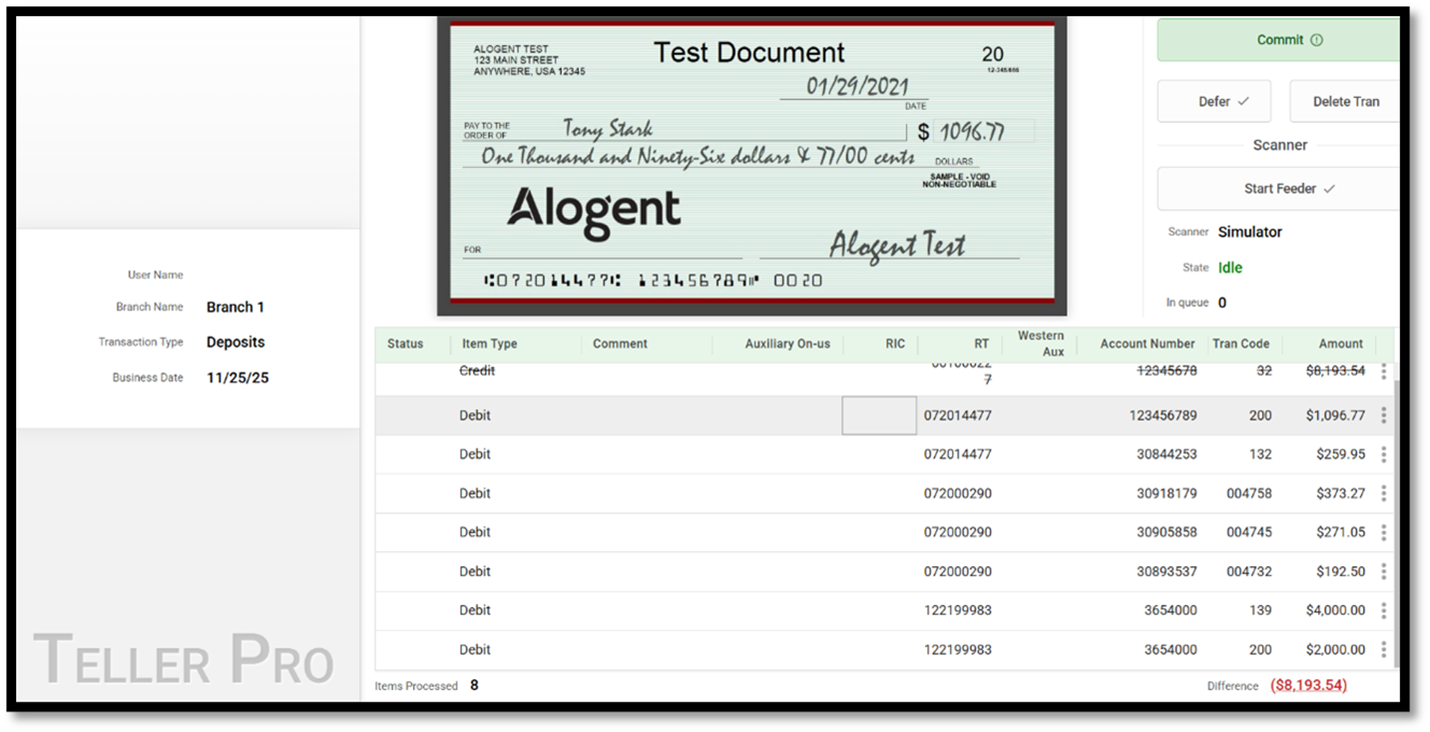

Modern teller capture platforms embed validation, risk checks, and exception handling directly into the deposit workflow. Rather than disrupting the tellers' processes, real-time capabilities work within them, providing immediate feedback without adding complexity. Platforms like Unify are purpose-built to seamlessly integrate with existing banking workflows and core platforms, enabling institutions to modernize teller processing without disrupting frontline operations.

How Real-Time Teller Capture Works with Unify

By embedding validations and reviews directly into the deposit workflow, real-time teller capture reduces operational inefficiencies, mitigates fraud risk, and enhances account holder confidence. Platforms like Unify make this possible without disrupting existing teller workflows or backend systems. For a detailed, step-by-step look of how Unify modernizes teller capture, see our Playbook for Optimizing Branch & Teller Capture with Real-Time Processing.

From Legacy Limitations to Real-Time Confidence: The Future of Teller Capture

Many institutions attempt to modernize deposit workflows through incremental add‑ons or siloed line of business solutions. While these can address specific gaps, they often shift complexity downstream, adding integrations and maintenance overhead without solving the core limitations of legacy infrastructure.

True modernization requires change at the infrastructure level. Unify delivers this with a single platform, one API, and real-time image and data validation across all deposit channels, including at the teller line—reducing technical debt rather than adding to it.

With Unify, banks and credit unions can finally move beyond legacy constraints and support real-time deposit processing, while preparing themselves for future payment innovation. Because while the check itself may not evolve, the way it’s processed absolutely must —allowing institutions to scale with confidence and keep pace with the trends shaping the future of payments.

Can Your Check Processing Solution Compete in Today's Landscape?

Download our Payments Modernization Checklist for Financial Institutions

read more: best practices for real-time Branch & Teller Capture

Be the first to know! Click below to follow us on LinkedIn for news and content updates!