Avoiding Exam Issues with a “Stronger” Approach to Exception Management

Managing exceptions can feel like busywork with minimal impact on a financial institution’s overall success. But, in reality, effective exception management is essential for mitigating credit risk and compliance issues—especially on commercial real estate loans.

According to the OCC’s Commercial Real Estate Lending booklet, part of the Comptroller’s Handbook, examiners consider a variety of exceptions when evaluating commercial real estate lending risks. Exceptions made to the general lending policy are of particular interest:

Examiners also should review lending policy exception reports to assess the frequency and nature of policy exceptions and to determine whether exceptions to the bank’s loan policy are adequately documented, approved, reported, and appropriate in light of relevant credit considerations. An excessive or significantly increasing number of exceptions to the CRE lending policy could indicate that the bank is unduly relaxing its underwriting practices, needs to revise its loan policy, or that its policies are inconsistent with the board’s risk tolerance. With respect to frequency and nature of policy exceptions, it is prudent for the bank to consider aging of all exceptions with sufficient stratification to identify trends in volumes, loan officer, and types.

—From Commercial Real Estate Lending published by the Office of the Comptroller of the Currency

Simply put, a growing number of exceptions raises red flags during exams and could expose your financial institution to excessive risk. Therefore, taking a stronger approach to exception management is a prudent decision.

“Weak” Exception Management & Reporting

The “Quality of Credit Risk Management Indicators” (Appendix B), included in the OCC’s Commercial Real Estate Lending booklet, provides examples of what a “weak” approach looks like. If the following indicators sound familiar, perhaps it’s time to start an internal conversation.

Policy Exception Approval, Reporting, and Analysis Deficiencies

OCC indicator: “Policy exceptions may not receive appropriate approval, significant policy exceptions may be approved but not reported individually or in aggregate, or their effect on portfolio quality is not analyzed. Risk exposures associated with off-balance-sheet activities may not be considered.”

Lack of Timely Information for Management and the Board

OCC indicator: “Management and board reports are deficient. The accuracy or timeliness of information may be affected in a material way. Management and the board may not be receiving sufficient information to analyze and understand the effect of CRE activities on the bank’s credit-risk profile.”

Inadequate Exception Reporting

OCC indicator: “Exception reporting requires significant improvement.”

Furthermore, Appendix A of the same document indicates that a “high level” of underwriting, loan documentation, or collateral exceptions is likely to catch examiners’ attention. Failing to mitigate such exceptions in a timely manner creates unnecessary risk.

Time for a “Stronger” Approach?

As you might expect, the OCC’s booklet counters the aforementioned “weak” scenarios with healthier practices. The following indicators caught our attention:

Comprehensive Policy Exception Management

OCC indicator: “Staff effectively identifies, approves, tracks, and reports significant policy, underwriting, and risk-selection exceptions individually and in aggregate, including risk exposures associated with off-balance-sheet activities.”

Reliable Access to Information for Management & the Board

OCC indicator: “Management and board reports provide accurate, timely, and complete CRE portfolio information. Management and the board receive appropriate reports to analyze and understand the effect of CRE activities on the bank’s credit-risk profile, including off-balance-sheet activities.”

Systems that Support Effective Exception Management

OCC indicator: “MIS facilitate timely reporting of exceptions.”

Clearly, the ideal approach is one that prioritizes careful exception management and reporting. Unfortunately, not every MIS (management information system) is capable of supporting this need. As a result, many banks and credit unions still track their policy exceptions, collateral exceptions, and document exceptions in spreadsheets—making it difficult to overcome “weak” practices.

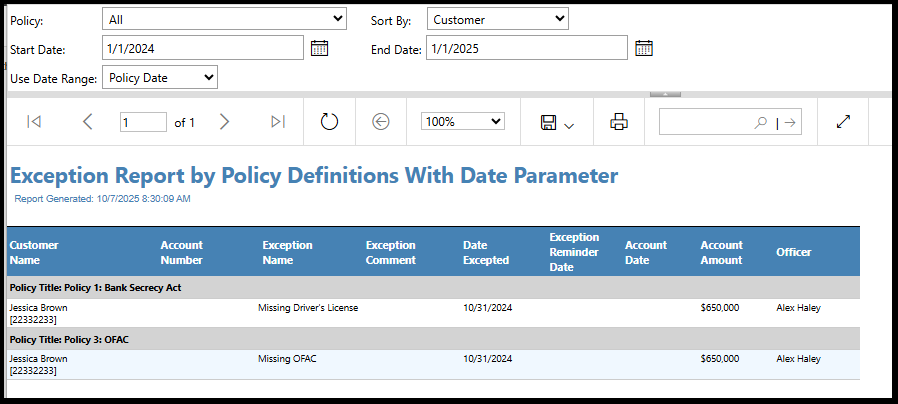

Alogent’s ECM software suite includes AccuAccount, a system that’s optimized for commercial lending. In addition to the software’s intuitive customer view that “looks like” a traditional loan file, AccuAccount offers powerful tracking and reporting capabilities for credit, collateral, deposits, trusts, and loans—including lending policy exceptions. Managers and board members can subscribe to policy exception reports that automatically appear in their email inboxes, saving time and reducing confusion.

With Dynamic Reporting for AccuAccount, bankers can easily build custom reports, export exception data for further analysis, and share exception reports with users at different branches.

Contact us to explore streamlined exception management with AccuAccount

watch on demand: track exceptions for loan administrators

Download: Free Exception Tracking Cost Calculator

Be the first to know! Click below to follow us on LinkedIn for news and content updates!