Streamlining Consumer Lending with a Comprehensive View of the Borrower

Borrowers expect quick access to financing without excessive documentation requests, but keeping everything organized can be challenging for lenders—especially when relationship information is spread across emails, network drives, LOS, and the core.

Centralizing borrower documents and relationship information in an enterprise content management system (ECM) helps lenders increase efficiency and deliver enhanced services. This article discusses how consumer lending teams can leverage FASTdocs.

Centralizing Borrower Information, Empowering Lenders

Lenders must carefully balance borrowers’ complex, ever-changing needs while continually making new connections and loans. Each relationship brings with it a host of personal interactions, phone calls, emails, disclosures, and documents.

Traditionally, much of this information was stored in the lender’s brain and in hard copy filing cabinets. The digitization of financial institutions’ records has streamlined access to certain information, but a new challenge has arisen: electronic information silos. Siloed information makes it difficult for lenders to quickly assess relationships and leads to duplication of effort—both for staff and the borrower.

FASTdocs, Alogent’s ECM solution that’s built specifically for banks and credit unions, solves many of these information management challenges by delivering:

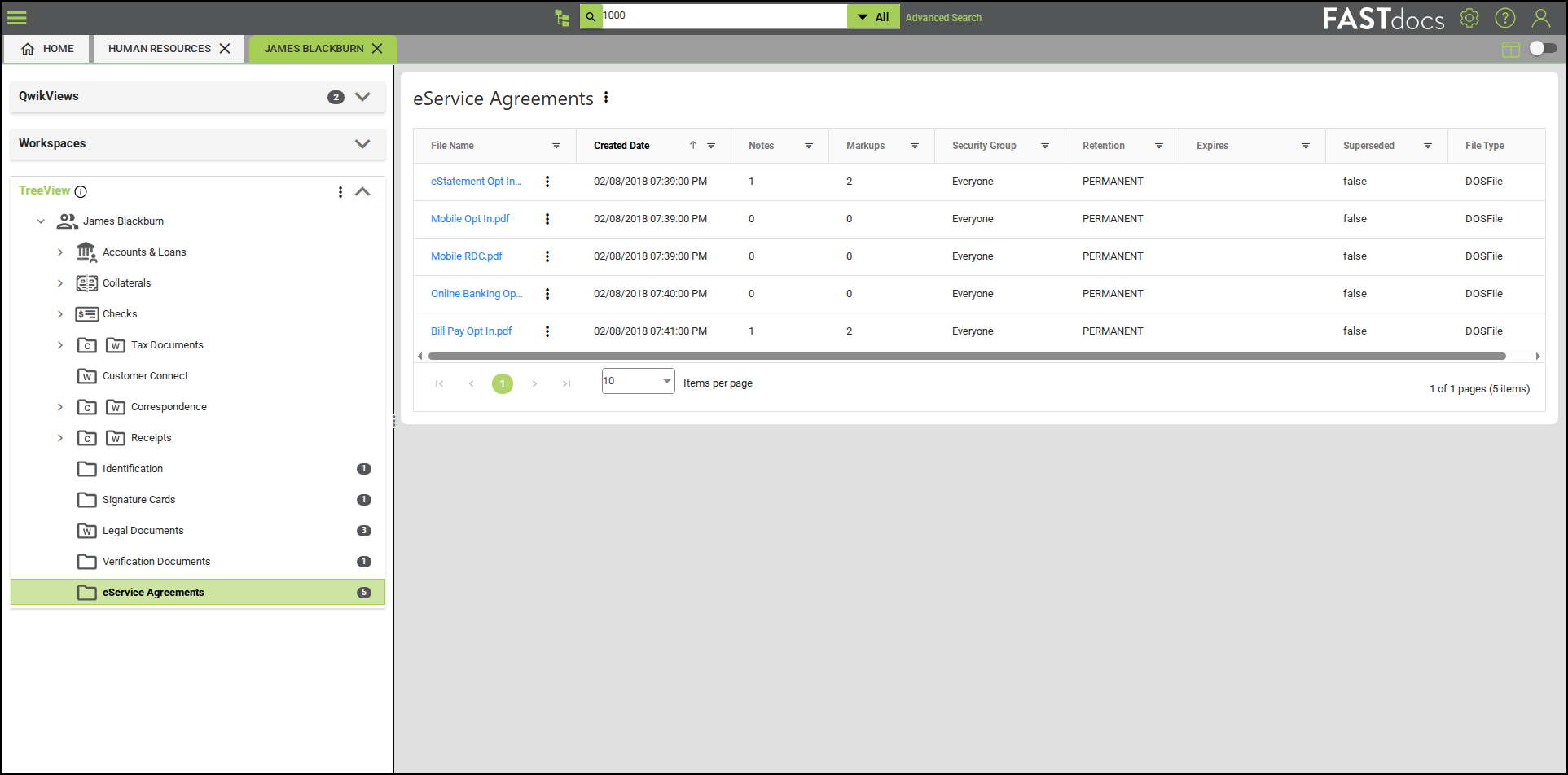

Hierarchical View of Borrower Relationships: Information in FASTdocs is organized in a person-centric way, accelerating lender access to customer or member information. Existing accounts, loans, collaterals, and documents are quickly accessible from an intuitive screen.

Quick Access from the Core: Integrating FASTdocs to your core presents additional opportunities to increase productivity. Our “app launch” feature allows lenders to jump from the core to a corresponding record in FASTdocs. In addition, our FASTdocs API opens the door to viewing documents without leaving the core.

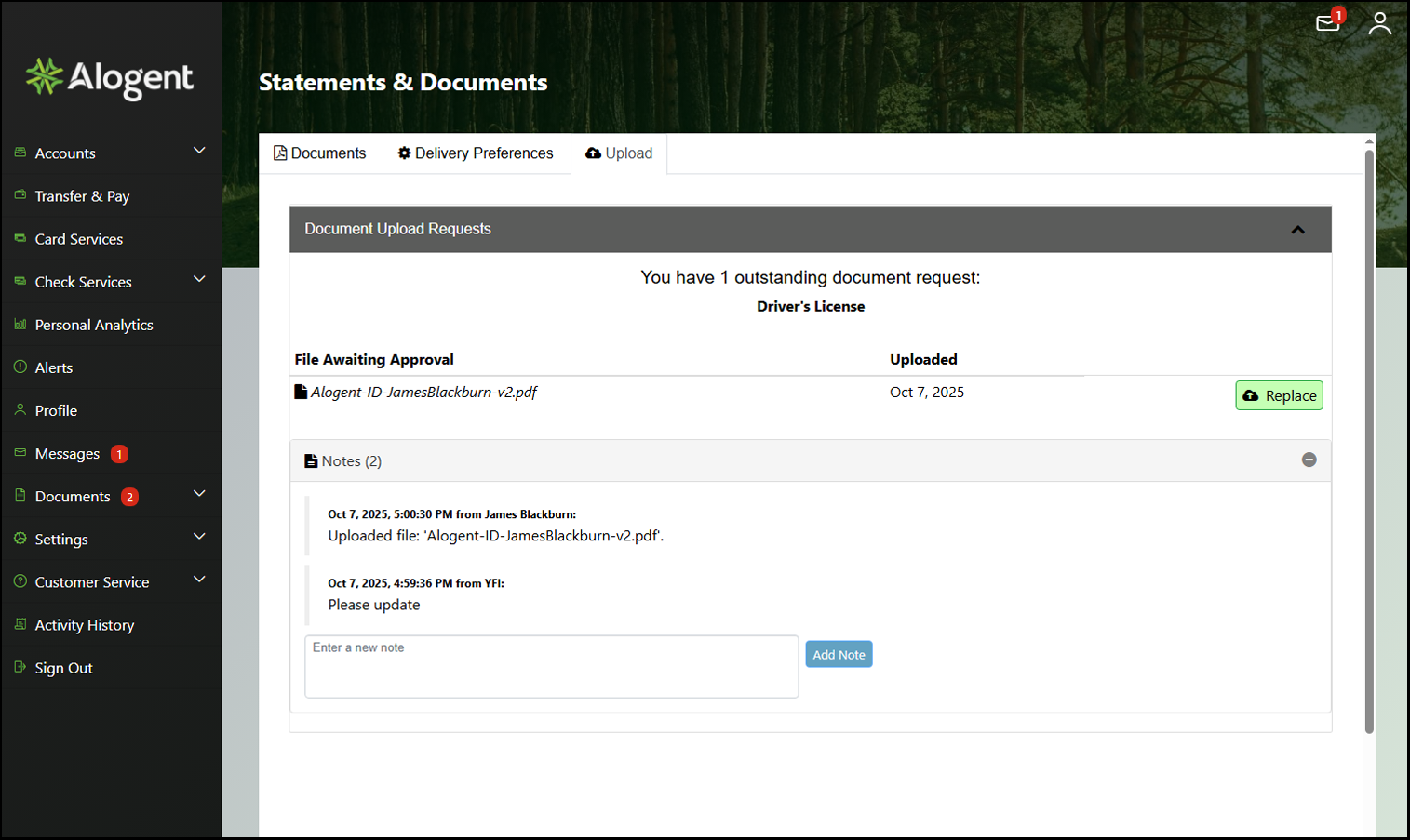

Intuitive Workflow for Requesting Borrower Documentation: Speaking of integrations, connecting FASTdocs to your digital banking makes it possible to enable a two-way information exchange. Lenders simply initiate a request in FASTdocs, and borrowers log into digital banking to upload the requested document(s). That means fewer trips to the branch for the borrower and a streamlined process for lenders.

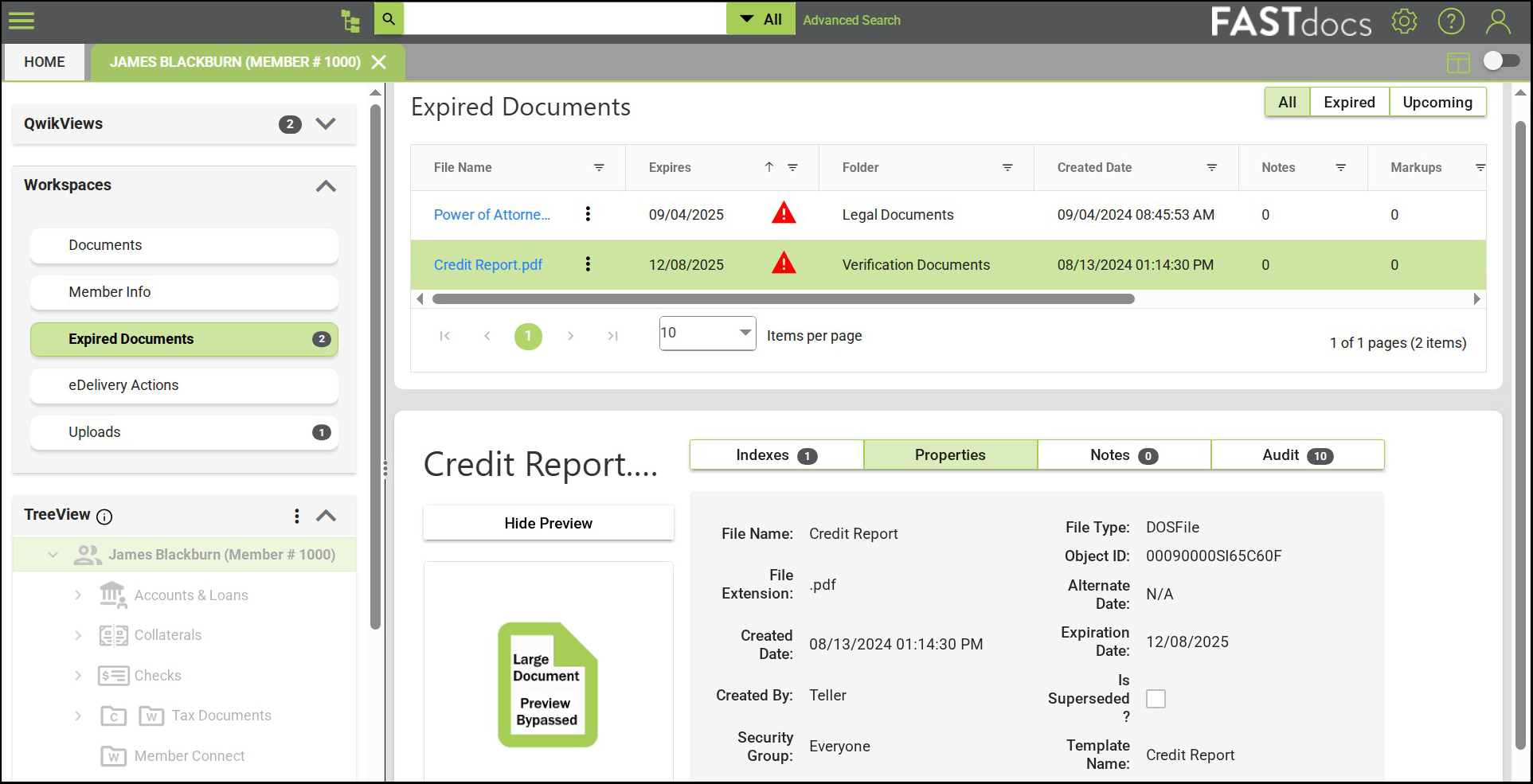

Document Expiration Dates: A customer seeking a personal line of credit one week after refinancing his mortgage would rightly expect an expedited experience. Assigning expiration dates to credit reports, driver’s licenses, proofs of income, and other documents in FASTdocs helps lenders understand documentation requirements and prevent lending delays.

Enabling Healthier Lending Relationships

Creating a reliable, consolidated view of each relationship reduces unnecessary administrative work and positions lenders to serve borrowers. If your bank or credit union is ready to centralize borrower information and empower lenders, contact our team at Alogent. We’ll be happy to schedule a personalized demo of FASTdocs.

Learn More: Powering Smarter Content Management with Document Versioning

Consumer Real Estate Collateral Checklist: ensure all documents are accounted for with this tool

Explore our suite of ECM solutions for financial institutions

Be the first to know! Click below to follow us on LinkedIn for news and content updates!