Are Your Policy Exceptions Increasing or Decreasing?

Tracking loan policy exceptions is essential for risk mitigation and compliance. To keep examiners and auditors happy, however, financial institutions should go beyond basic reporting and embrace a more proactive approach—one that monitors policy exception trends.

According to the Commercial Real Estate Lending booklet, part of the Office of the Comptroller of the Currency's (OCC) Comptroller's Handbook:

“Examiners also should review lending policy exception reports to assess the frequency and nature of policy exceptions and to determine whether exceptions to the bank’s loan policy are adequately documented, approved, reported, and appropriate in light of relevant credit considerations. An excessive or significantly increasing number of exceptions to the CRE lending policy could indicate that the bank is unduly relaxing its underwriting practices, needs to revise its loan policy, or that its policies are inconsistent with the board’s risk tolerance.”

—Commercial Real Estate Lending booklet, published on OCC.treas.gov

Don’t wait for examiners to discover an “excessive or significantly increasing” amount of policy exceptions at your financial institution. Instead, stay on top of policy exception trends with AccuAccount, Alogent’s ECM solution that’s built for commercial lending. Here’s how it works.

Monitor Policy Exception Trends with AccuAccount

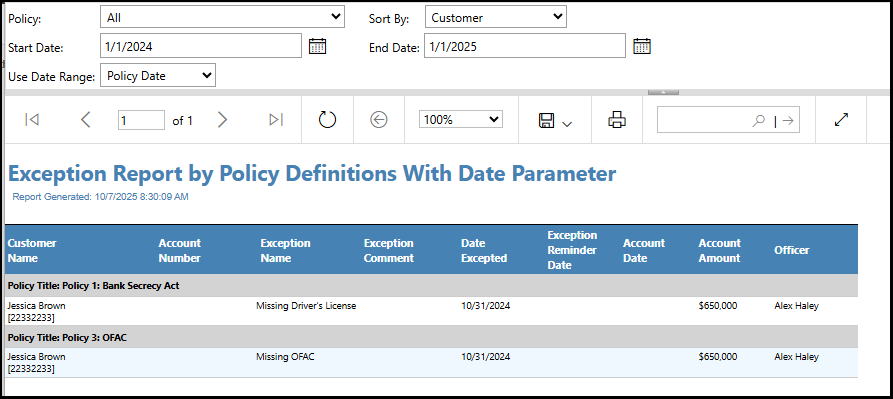

Banks and credit unions that use AccuAccount enjoy a variety of prebuilt reports, including “Exception Report by Policy Definitions.” This powerful report returns a list of policy exceptions that were added to AccuAccount within the selected date range.

As seen in the previous illustration, only two policy exceptions were entered during the given date range—both on Halloween 2024. Notice that the report includes the associated customer and loan policy definition.

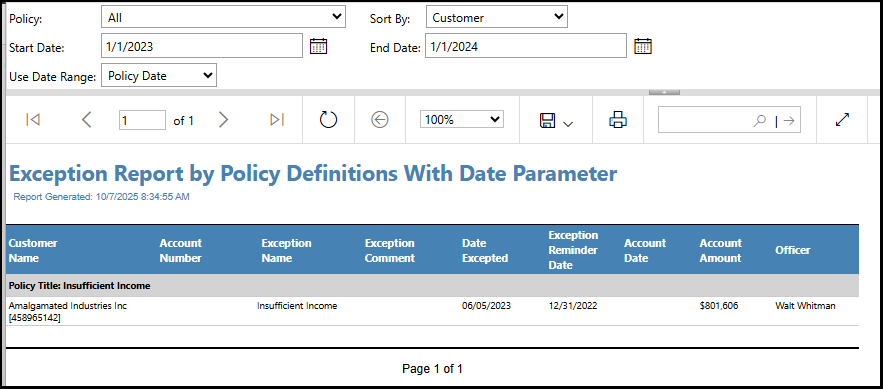

Adjusting the date range for the prior year provides a helpful point of reference.

In this simple example, the financial institution experienced year-over-year policy exception growth (although the sample size is rather small!)

Subscribe to Policy Exception Reports via Email

As with other standard reports in AccuAccount, email subscriptions can be configured for board members, lenders, loan administration staff, and other users in the system.

Once enabled, subscribed users will receive policy exception data in their inboxes on a regular basis. Your VP of Commercial Lending might opt to receive this report on the first day of each month, reminding him or her to compare activity to prior months. A board member, however, may prefer to receive the same report quarterly. AccuAccount allows users to receive the same report on different schedules—without manual data extraction and manipulation.

See a Demo of Our Policy Exception Features

Simplify your tracking, reporting, and management of loan policy exceptions with AccuAccount.

Request a demo to learn more about our policy exception capabilities

Playbook: Managing Policy Exceptions in AccuAccount

Be the first to know! Click below to follow us on LinkedIn for news and content updates!