Getting Started

Unify makes it easy to extend mobile remote deposit capture into your institution’s existing mobile app. This page outlines the technical requirements for integrating Alogent’s Unify solution with your mobile banking platform. It includes an integration checklist, sample API request, and key considerations to help guide setup, testing, and deployment.

Integration Overview

Capabilities

Unify supports multiple integration approaches depending on your institution’s needs:

- Mobile RDC Image Capture: Leverage the device’s native camera for deposit image capture

- Commercial SSO Support: Integrate with Alogent’s UI via identity providers such as OpenID Connect or SAML

- API Integration: Direct integration with the API or through our middleware for seamless connectivity

- Core Support: Compatible with Corelation, Symitar, Miser, and other leading core platforms

Key Considerations

- Workflow must be validated in CAT before production deployment.

- Limit enforcement should align with FI policies.

- Ensure integrator IPs and certificates are coordinated early to avoid delays.

- Consider performance impact when choosing API submission method.

- Workflow diagram available upon request.

Integration Checklist

1. API Origin

| |

2. Client Certificate for CAT Testing

| |

3. Integrator IP Whitelisting

| |

4. Deposit Submission Method

| |

5. Limit Enforcement

| |

6. Limit Enforcement Workflow

| |

7. Deposit History Display

| |

8. Batch Posting & Notifications

| |

9. Member Notifications

|

10. Sample API Request

|

POST {alogent-base-url-path}/api/simple-tran/capture-tran { |

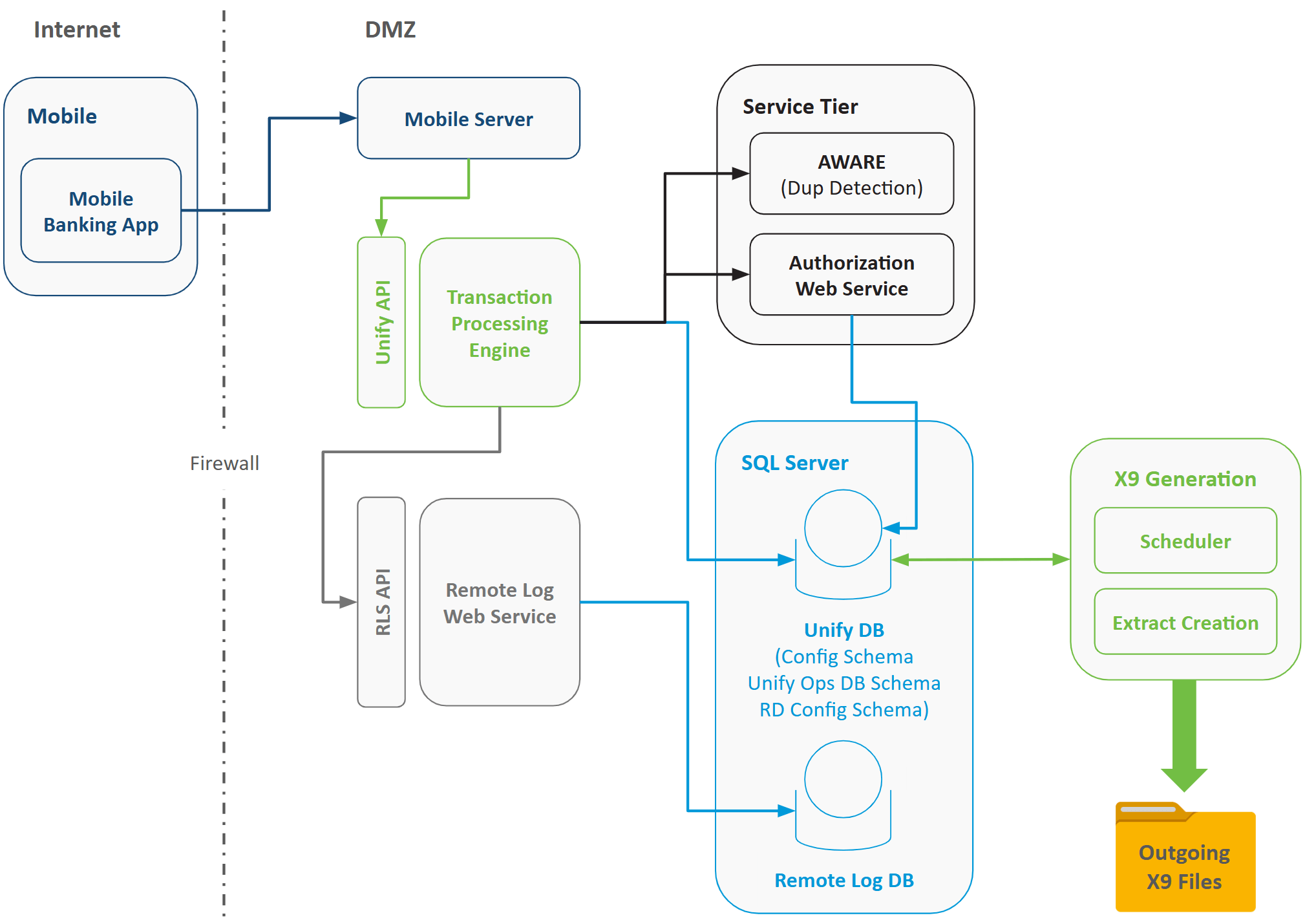

Workflow Diagram