Don't Let Imaging

Slow Down Your Lending

Document imaging software should accelerate lending—not slow it down. AccuAccount is built for lenders like you.

Document Management System for Lenders:

Accelerate your loans and renewals by having all of your documents in one place—and at your fingertips.

Easily search for and find each account holder’s financials, credit presentations, tax returns, applications, and collaterals. Stop asking for the same document twice.

Exception Automation:

Eliminate exception management headaches from your life.

Get daily exception reports sent straight to your inbox each morning. Free up more time for yourself and your loan admin by automatically clearing exceptions as documents are imaged into the system. Put your exception management workflow on autopilot.

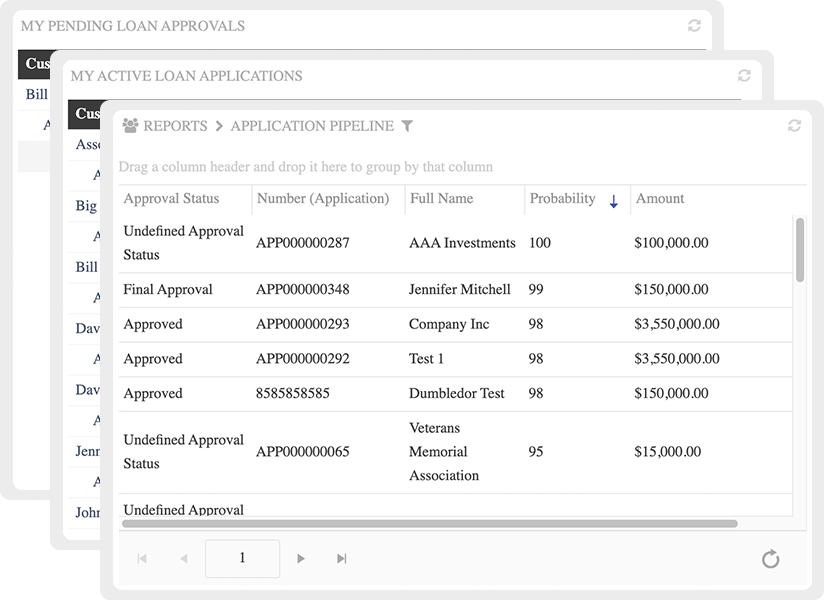

Customizable Dashboards:

Quickly access your pipeline, customers, and accounts with customizable dashboards and reports.

Stay organized with dashboards that provide at-a-glance access to your top customers, largest loan portfolios, tasks, and needed documentation. Drag and drop data fields to build custom reports in seconds.

Loan Approval Workflows:

Route, approve, and renew your loans with ease.

Build a scalable approval workflow for each loan type. Electronically route and approve loan applications and renewals. Simplify the renewal process for repeat customers by centralizing the management of your credit documents.

Dynamic Reporting:

Know your customers with a 360-degree view of their relationships and accounts

Built-in document tracking maximizes the impact of your imaging workflow. Exceptions automatically clear as new documents are scanned in or uploaded into AccuAccount. Trigger new exceptions automatically based on the customer or account type. Data-driven exception reports and email alerts keep everyone informed.

Improve Your Lending Process with AccuAccount

Take the Next Step

AccuAccount frees up more of your time to focus on lending. All of your customer, member, and account-related documents are stored securely in an easy-to-use electronic system. Exceptions clear automatically as new documents are uploaded. Reports appear in your inbox each morning. Learn more about how AccuAccount can simplify your days.

No Registration Required

Watch a brief intro to learn how AccuAccount can improve your lending process.

No Registration Required: AccuApproval Demo

No Registration Required: CTS Testimonial

FAQs

SEE OUR SOFTWARE IN ACTION

See an on-demand demo of AccuAccount. Learn how our software integrates to 30+ core systems and loan origination systems, streamlines imaging, and automates exception tracking and audit preparation for 15,000+ bankers.

Free Printable PDFs:

Reports for Lenders

Study of 95 Bankers

Learn how 95 other bankers approach loan approval. Insights from real bankers.

[eBook] Case Studies

Download a free case study eBook to learn why six community banks opted for AccuAccount instead of core-provided modules.