Case Study: Why MNB Bank Switched from a Core Imaging Module to AccuAccount

MNB Bank is a $353 million community bank that serves families, businesses, and farms in southwestern Nebraska. Founded in 1907, MNB Bank offers a full-service selection of personal and business banking solutions, including agricultural and commercial loans.

After more than one hundred years in business, the bank decided to migrate to an electronic loan document management system. Soon after starting the process, however, the team realized that its core imaging module could not fully meet its document management needs.

In this case study, you’ll learn why MNB Bank switched to AccuAccount.

“If you want your staff to actually use the documents in your loan files, then you need a system that is all-encompassing. AccuAccount is definitely the way to go.”

Tim Wiebe, Vice President, Credit Administration Manager at MNB Bank

The Search for a User-Friendly Imaging System

In 2015, MNB Bank decided to transition from paper to electronic loan files. The bank already owned and utilized Director® from Fiserv, a popular ECM used by many financial institutions, which made it the logical repository for credit and loan documentation. Digitizing loan documents helped the bank reduce its risk of information loss, but several new issues arose.

“Loan officers struggled to find documents in the new system, resulting in a very low adoption rate,” said Tim Wiebe, Vice President, Credit Administration Manager at MNB Bank. “Officers needed help from loan assistants just to find documents, which was not an efficient use of anyone’s time.”

To complicate matters, MNB Bank had to use a separate manual tickler system to track document-related exceptions. “Employees had to first realize a document was missing and then set up an exception,” Wiebe said.

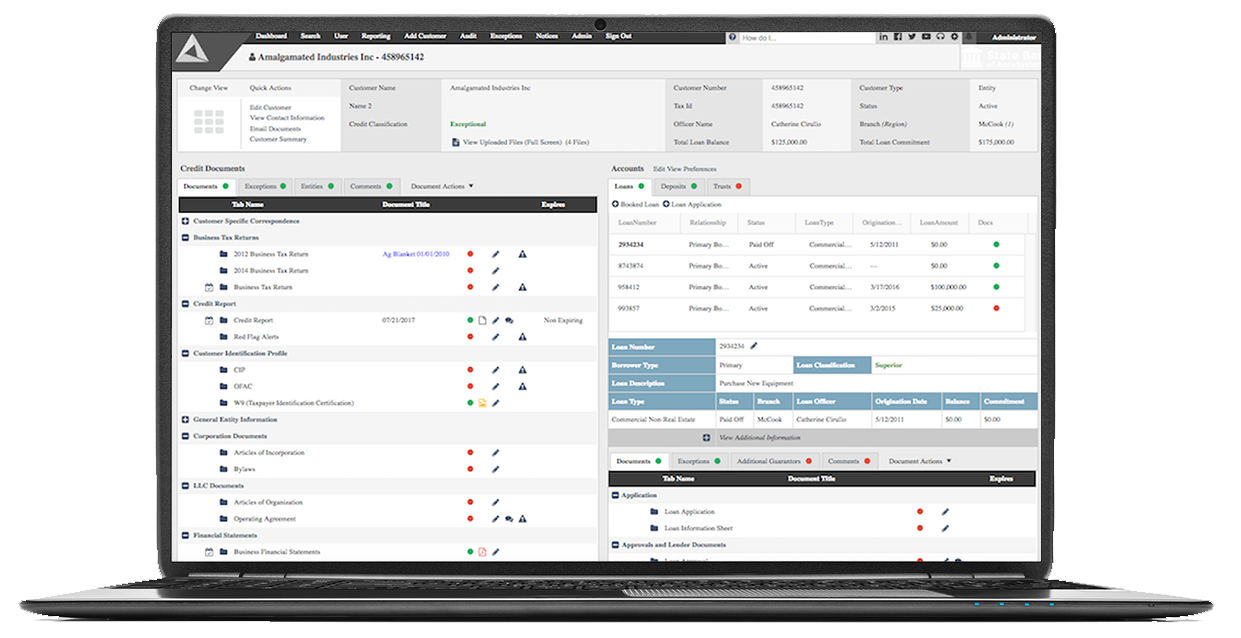

Realizing the need for a more user-friendly system that could streamline the management of commercial and ag loans, MNB Bank turned to AccuAccount. After seeing a demo of the software, the team was impressed by the system’s ease of use and organizational structure.

“AccuAccount organizes customer and account information in a visually intuitive format, which makes it easy to know where everything is located,” Wiebe said. “The system’s ease of use was the first thing that caught my eye.”

Customizability was another important consideration for MNB Bank.

“We wanted a system that could easily adapt to our workflow structure,” Wiebe said. “AccuAccount’s flexibility makes it possible to organize certain elements chronologically instead of alphabetically, which aligns with how lenders do their jobs.”

After carefully weighing the benefits and costs, MNB Bank decided to move forward with AccuAccount.

AccuAccount Elevates User Adoption at MNB Bank

Alogent's support team promptly went to work to ensure a smooth transition for MNB Bank.

“Within a couple of days, all of our important documents had been moved to the correct locations within AccuAccount,” said Jennifer Hazen, Loan Administrator at MNB Bank. “The Alogent team did a fantastic job to make sure our documents were transferred correctly.”

MNB Bank experienced a noticeable uptick in productivity and user satisfaction soon after going live with AccuAccount.

“System adoption was quick and extensive, especially among lenders,” Wiebe said. “Loan specialists are also much happier. We’ve heard zero complaints about AccuAccount.”

Contributing to the efficiency gains is AccuAccount’s similarity to a traditional loan file. “AccuAccount is designed to look like a paper loan file, which is what lenders are accustomed to,” Hazen said.

AccuAccount offers many additional benefits when compared to paper loan files – not the least of which includes document indexing and search.

“Users can open up a webpage and gain instant access to each customer’s information and related documents,” Hazen said. “Searching and notating documents is also easy, which saves our loan specialists and officers significant amounts of time.”

Integrated Exception Tracking Accelerates Productivity

AccuAccount’s integrated document tracking feature is also making an impact on MNB Bank’s productivity.

“AccuAccount is completely changing and improving how we deal with missing documents,” Wiebe said. “The system automatically tells you when something is missing, instead of relying on manual ticklers.”

Exception automation is allowing the bank to reallocate staff to more value-added activities.

“With automated exception tracking, our loan assistants have one less thing to worry about,” Hazen said. “Eliminating this manual process frees up additional capacity to focus on other initiatives.”

AccuAccount’s ability to manage grace periods and automatically schedule new exceptions is another key benefit to the bank.

“AccuAccount alerts us thirty days in advance of a document’s expiration date,” Wiebe said. “This helps us reduce exceptions and ensure an optimal experience for customers.”

Worth the Investment

So, was the switch to AccuAccount worth it for MNB Bank? Here’s what Tim Wiebe, Vice President, Credit Administration Manager at MNB Bank had to say:

“Purely from a human capital standpoint, AccuAccount delivers tangible ROI. There’s nothing on the market that closely compares to AccuAccount, and it’s definitely worth the investment. AccuAccount contains everything you need from a document management perspective.”

Ready to make the switch to AccuAccount? Watch a 2-minute overview of our software.