SBA Loan Document Management

“Mr. Jenkins, you seem like the natural fit for an SBA 7(a) loan.” Immediately after hearing these words, a glimmer of hope appeared on Mr. Jenkins’ face. For more than a decade, Mr. Jenkins has invested long nights and weekends to perfect his patent-pending chimney cleaning robot. Now, it’s finally ready for commercialization, and he’s even generated a viable cashflow by partnering with several well-known multinational brands. Unfortunately, Mr. Jenkins doesn’t have the funds to acquire equipment, supplies, and machinery that are necessary to ramp up prototyping and production. To complicate matters, he’s already been turned down by several lenders due to his company’s uncertain revenue outlook. According to his well-crafted business plan, Mr. Jenkins’ needs $250,000 to achieve liftoff. That’s where the SBA 7(a) loan comes in. For lenders like you, SBA loans can be a great way to help clients, like Mr. Jenkins, achieve their business dreams - without exposing your financial institution to unnecessary risk. As with any government-backed program, however, there are several important guidelines that must be followed by lenders. Let’s take a closer look.

SBA Guaranty & Documentation for 7(a) Loans

Among the SBA loan guaranty programs, the 7(a) loan is often cited as the Small Business Administration’s flagship loan guaranty program. As the Office of the Comptroller of the Currency points out here, “The program helps creditworthy small businesses acquire financing when they cannot otherwise obtain credit at reasonable terms.” Although the SBA does not directly provide the funds to the borrower, in the event of a default, the SBA would pay off the guaranteed portion of the remaining balance. Depending on the type of 7(a) loan, the guaranteed amount can be up to 85%. With the SBA sharing such a large percentage of risk for 7(a) loans, lenders must take extra precaution to ensure they’re following all of the SBA’s guidelines. (For starters, check out this guide, “Banker’s Guide to the SBA 7(a) Loan Guaranty Program). For example, during the application process, the amount of upfront documentation the bank must collect and submit to the SBA depends on the program, loan amount, and the lender’s experience with making SBA loans. Read more about application requirements here. The SBA also offers several checklists for lenders to refer to, some of which include:

- 7(a) Loan Application Checklist

- SBA 7(a) Loan Guaranty Checklist

- SBA 7(a) Submission Checklist for Regular 7(a) and CAPLines

Upon guaranty approval by the SBA, the bank is permitted to close the loan. As with any other commercial loan, lenders must have systems in place that allow them to “evaluate, process, close, service, liquidate, and litigate small business loans.” In addition, SBA requires additional ongoing reporting. As pointed out here, “Each lender must provide a monthly report on SBA Form 1502 that includes loan status information for all of the lender’s SBA-guaranteed loans.” Download a copy of the SBA form 1502 here. It’s also worth noting that the SBA has authority to deny its guaranty, as outlined on page 13 of this guide. Implementing robust document tracking procedures is one tactic for avoiding SBA guaranty denials.

Simplifying SBA Document Management

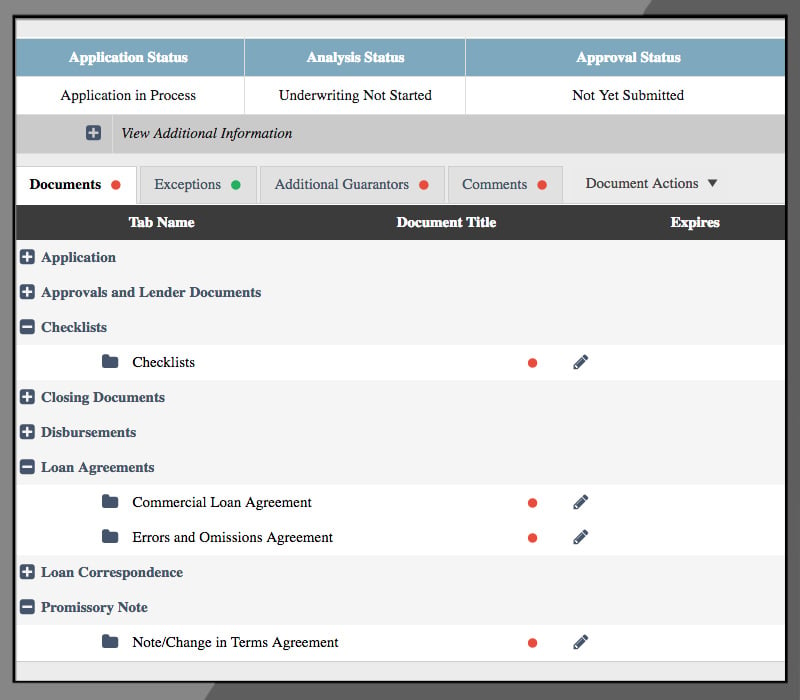

Relying on paper documents and manual ticklers complicates the management of SBA-related documentation. Alternatively, an integrated bank imaging and tracking system, such as AccuAccount, simplifies the entire process for the entire life of each loan. With AccuAccount, you can customize your document structure such that when a 7(a) loan is made, all of the correct document placeholders prepopulate into the customer’s electronic loan file. Rather than jumping between the SBA’s checklists, paper file folders, and spreadsheets, AccuAccount organizes everything into an intuitive and organized format.

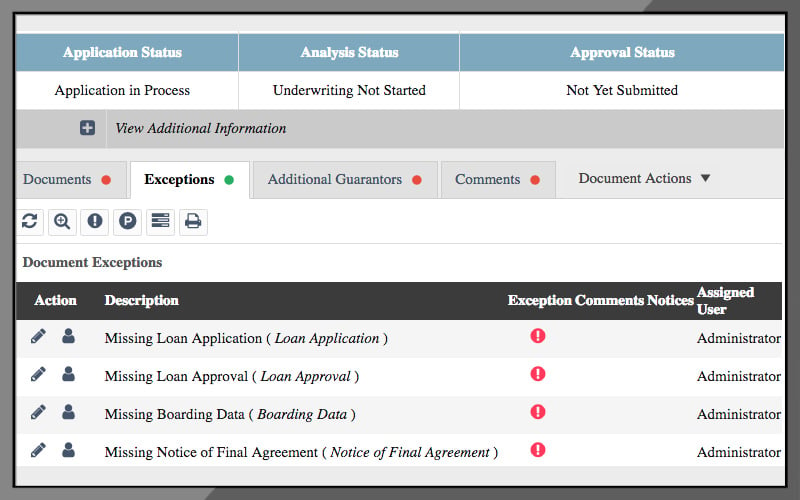

AccuAccount streamlines the submission of SBA applications by simplifying your exception management workflow. With integrated exception reporting, you and your lending team can easily identify which customer documents are still outstanding and which have already been collected.

After you’ve booked an SBA loan to the core, AccuAccount manages ongoing tracking obligations for the entire life of each SBA loan. As you scan and upload financials, tax returns, insurance policies and other ongoing documents, exceptions are automatically cleared by AccuAccount. Exception emails keep everyone in the loop, which prevents documents from slipping through the cracks. Finally, our AccuDoc platform is a great place to store scanned copies of Form 1502 that you’ve submitted to the SBA.

SBA Loan Document Management, Simplified

If you’re ready for a streamlined approach to SBA loan document management, it’s time to automate your entire workflow with AccuAccount. Our software is easy to implement, makes everyone more efficient, and helps your bank maintain compliance for 7(a) loans and other SBA programs.

Contact us today for a risk-free demo

Be the first to know! Click below to follow us on LinkedIn for news and content updates!