How to Electronically Share Credit & Loan Files with Examiners

The Commercial Loans (Section 206) booklet, part of the Office of the Comptroller of the Currency's (OCC) Comptroller's Handbook, sets forth examiner procedures for evaluating financial institutions’ commercial lending practices. Assessing risk is an important focus of the booklet, which includes steps for determining if institutions engage in risky behavior. The ninth item in the list caught our attention:

“Obtain credit files for all borrowers in the sample and document line sheets with sufficient information to determine quality and/or grade.”

—Commercial Loans (Section 206) booklet, published on OCC.treas.gov.

Not surprisingly, bankers who have been through exams are familiar with this step. Providing examiners what they need is easier when using a system like AccuAccount. Here’s why.

When Traditional Exam Prep Methods Fall Short

Traditionally, financial institutions maintained their commercial loan and borrower information in paper files. So, when examiners submitted their requests, considerable administrative effort was necessary due to:

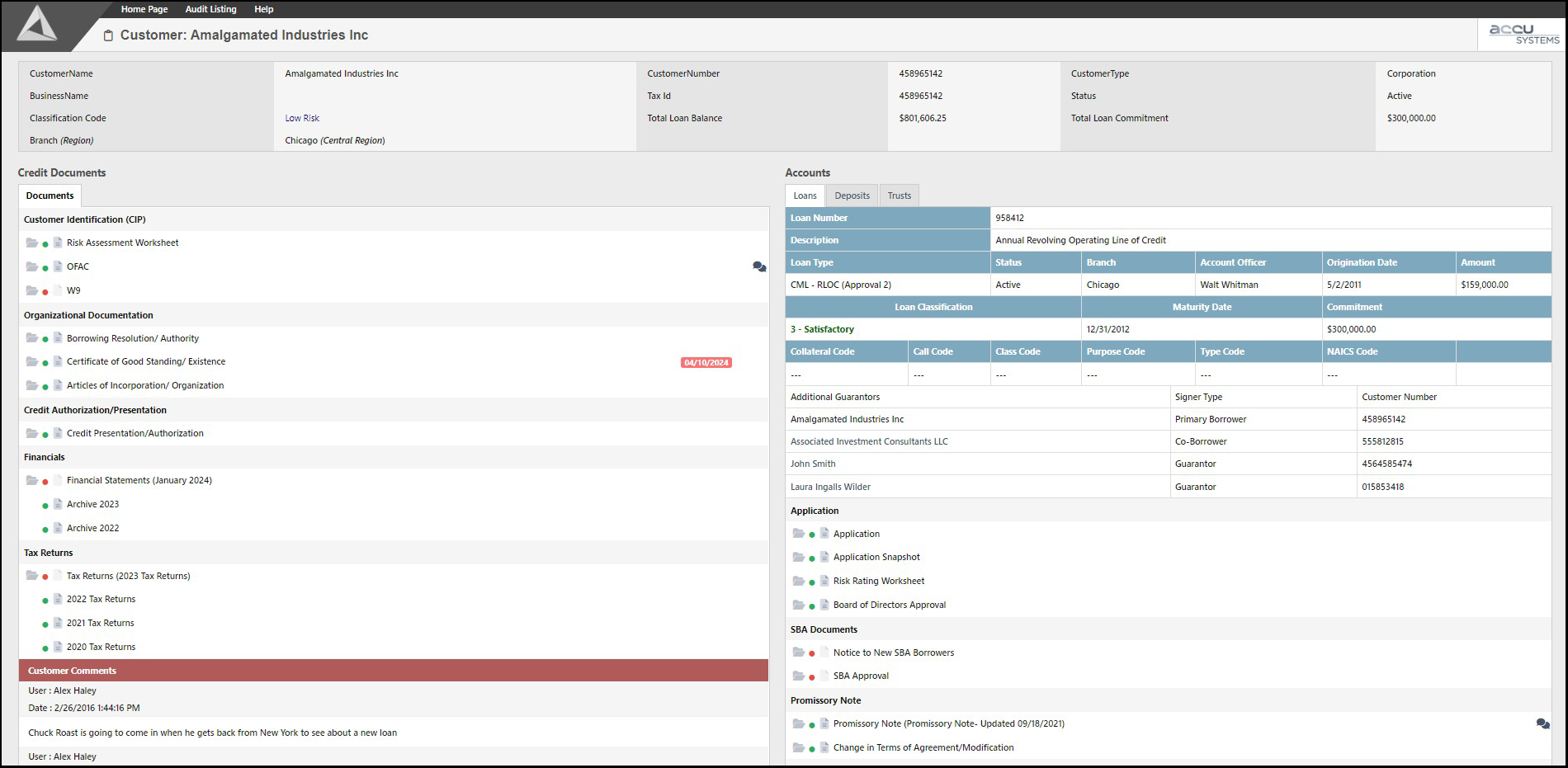

Complex relationships: One commercial relationship could involve multiple entities and guarantors, which adds complexity and creates recordkeeping nightmares—especially when information is spread across multiple folders.

Accessibility challenges: Unlike digital records, paper loan files are only accessible from a single location. If a loan file is checked out to a lender, for example, it must be tracked down and physically moved to the exam site.

Missing information: Sometimes loan files contain incomplete information due to expired borrower documents (also referred to as document exceptions). Scrambling to resolve exceptions before exams is stressful and causes unnecessary distractions.

Paper overload: Leafing through stacks of commercial files can be incredibly frustrating, especially when guarantor information is missing or in the wrong place. Off-site exams become practically impossible with a paper-based approach.

Preparing for Exams with AccuAccount

Digitizing commercial credit and loan documentation is a smart step toward better exams. That said, implementing proper document structures, exception management protocols, and exam prep workflows is also prudent. That’s where AccuAccount comes in.

AccuAccount is Alogent’s ECM (enterprise content management) software that’s optimized for commercial lending. AccuAccount combines intelligent document management and exception tracking with an intuitive audit and exam prep feature.

Here’s a quick overview of exam and audit prep in AccuAccount:

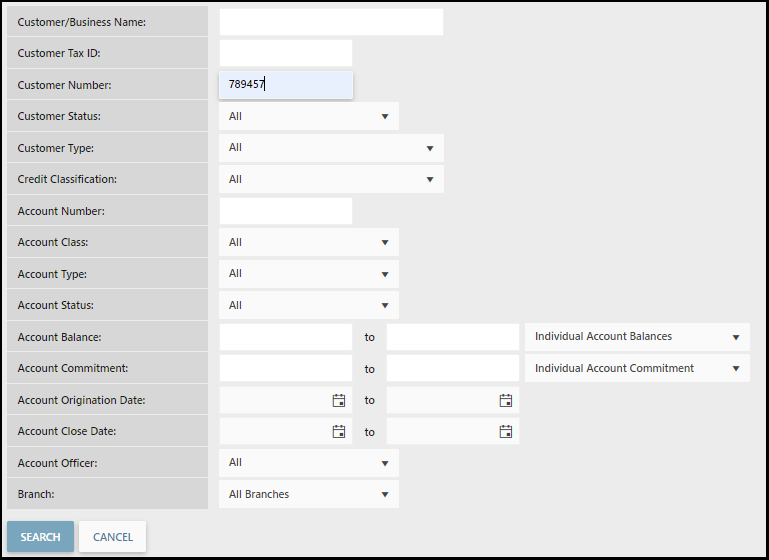

First, a team member logs into AccuAccount and creates the digital audit file. Locating customer and loan information is quick and easy:

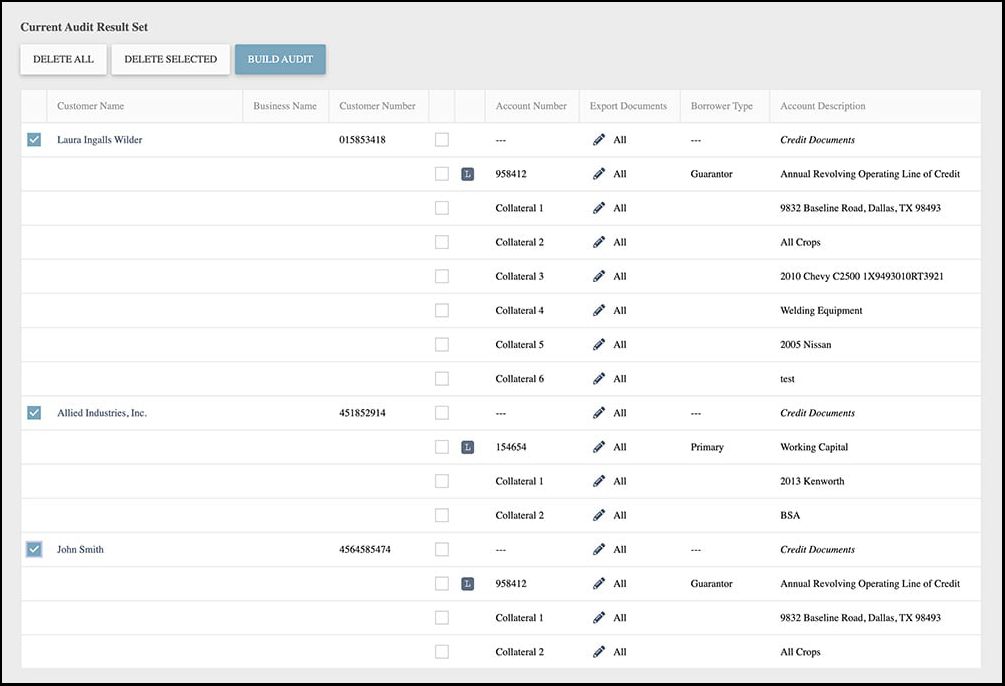

After adding requested information to the audit file, the team member simply “builds” the audit in AccuAccount.

Sharing credit and loan information with examiners is as easy as exporting and saving the file to a disk (or uploading it to the examiner’s secure portal). Examiners do not need their own instance of AccuAccount. And, even better, they can drill down into guarantors’ credit files for a more complete view of each relationship (without requesting more files from you!).

Give Examiners What They Need

At the end of the day, examiners need an easy way to evaluate your institutions’ commercial lending activities. They need the full picture of each relationship—without endless digging through stacks of paper. AccuAccount can help.

Request a demo of audit and exam prep in AccuAccount

Be the first to know! Click below to follow us on LinkedIn for news and content updates!