Tracking Total Application Time and Pipeline Bottlenecks in the Commercial Lending Process

Loan file complexity, manual processes, and lender oversights aren’t the only things getting in the way of efficient commercial lending workflows. Being able to accurately track commercial lending pipelines and related metrics—especially total application time—is key for identifying bottlenecks, streamlining operations, and ensuring smooth experiences for customers and members.

Let’s take a closer look at how technology can help financial institutions elevate the impact of their commercial lending metrics and workflows.

Roadblocks to Clarity in Commercial Lending

Each commercial loan will likely involve many stakeholders, multiple pipeline stages, and days or weeks of careful consideration as it advances from application through approval. Multiply this complexity across dozens or hundreds of commercial loans, and it’s easy to see why simply managing daily operations keeps some financial institutions from ever improving their pipeline tracking and reporting practices.

However, failing to zoom out and see the “big picture” is not a viable long-term strategy. After all, even the most productive lending institutions experience occasional process failures, miscommunications, and personnel issues—all of which can divert attention from the customer or member experience and negatively impact employee satisfaction.

Financial institutions need an objective, automated way to track how long each lending stage is taking—and where things keep getting stuck.

Create Accountability and Transparency with Automated Timers

Financial institutions can use AccuAccount in tandem with AccuApproval, our commercial loan approval workflow solution, to automatically track important steps in the lending process as well as total application time.

Here’s how it works:

- Decide what you want to track: Track total application time or specific pipeline statuses, such as lender approval or committee approval.

- Configure your timers: Tell AccuApproval which workflow actions should start or stop timers, such as steps that lenders are expected to take during a particular stage in the pipeline. Timers continue to run until an expected action is completed by an assigned user. Each action is timestamped in the system to avoid potential confusion.

- Define what is an “acceptable” amount of time: For example, you might set a seven-day acceptable window for pre-closing documentation preparation.

- Receive notifications for loans that are falling behind: Automated emails keep users informed about upcoming deadlines.

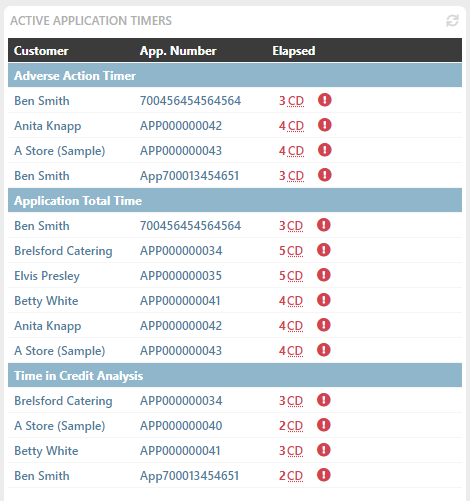

At any point, users with proper access can view loan application timer information from their AccuAccount dashboards. The following example shows three application timers, each containing multiple loan applications that have fallen behind.

Gain a Fresh Perspective into Your Commercial Loan Pipeline

Using tools like AccuAccount and AccuApproval can bring a fresh new perspective into the commercial lending process. Users are automatically prompted to take actions, managers can see what is in danger of falling behind, and dashboards provide up-to-date information about in-process loans and timers.

Download a solution overview to learn more

Get started with a personalized demo

Be the first to know! Click below to follow us on LinkedIn for news and content updates!