Automating Compliance for Your Bank Retention Schedule

“Steve, it’s that time of the month again. We need you to go down into storage, find the records set for destruction, and shred them.” As you descend into the crypt-like catacombs of the downtown branch, you can’t help but feel discouraged. “Is this really the best use of my time?,” you think to yourself. Frustrating as it may seem, your bank or credit union has an obligation to uphold its retention schedule. And, unfortunately for you, ensuring retention schedule compliance isn’t exactly the most glamorous job. The good news is that shredding thousands of documents gives you plenty of time to think. Here’s some food for thought.

Shredding Isn’t the Only Inefficiency

After clearing off the cobwebs and dust bunnies from box B9, you settle in for a long afternoon of fun. There are only 6,000 pieces of paper to shred, which, based on last month’s performance, should take about four hours to complete. As the shredder feasts on old loan files, your mind races with the dozens of emails that you still need to answer today. However, since your phone doesn’t get service in the basement, multitasking won’t be an option. Instead, you find yourself pondering all the other ways this paper-based system is wreaking havoc at your institution:

Retention Log Headaches: Because your bank or credit union's retention schedule is tracked in a spreadsheet, you’ve become the point person for ensuring the log remains up to date and accurate. When a box needs to be checked out, guess who manages all its comings and goings? You do, of course.

Distracting Subpoena Requests: Speaking of checking out boxes, it’s not uncommon for paid off loans to be subpoenaed. When this happens, you’re forced to stop what you’re doing, locate the box, have it couriered, update your retention log, and ensure timely retrieval. All the while, your bank or credit union never stops generating new documents, which adds to the confusion.

Delays & Bottlenecks: Paper documents can only be in one place at one time. So, when someone needs quick access to a paid off loan file, it’s your job to process their request in a timely fashion. Trouble is, you can’t spend every moment digging through endless boxes of paper. The longer it takes you to fulfill requests, the more you hear about it from your coworkers.

Risk of Information Loss: You can’t help but consider the risk associated with maintaining everything in hard copy format. Sure, your bank or credit union has taken preventative measures to ward off information loss, but not every situation is foreseeable - or preventable. No doubt, having a basement full of old documents presents a real risk for your institution.

Electronic Document Retention Solves These Issues

As you emerge victorious over the 6,000 documents, you go straight to your desk and begin researching how other community banks and credit unions have overcome the shortcomings of paper document management. To your delight, you stumble upon AccuAccount, an electronic document system designed specifically for community banks and credit unions. AccuAccount solves your document retention issues in two main ways. For starters, AccuAccount cuts down on paper during approval and booking. Rather than saving every single file in hard copy format, AccuAccount makes it easy to validate, scan, QC, and index documents into an intuitive electronic ecosystem. Unlike some systems that are structured into a folder-based hierarchy, AccuAccount organizes your documents by customer and account. Each customer and account has its own document structure, creating accessibility and transparency for internal stakeholders.

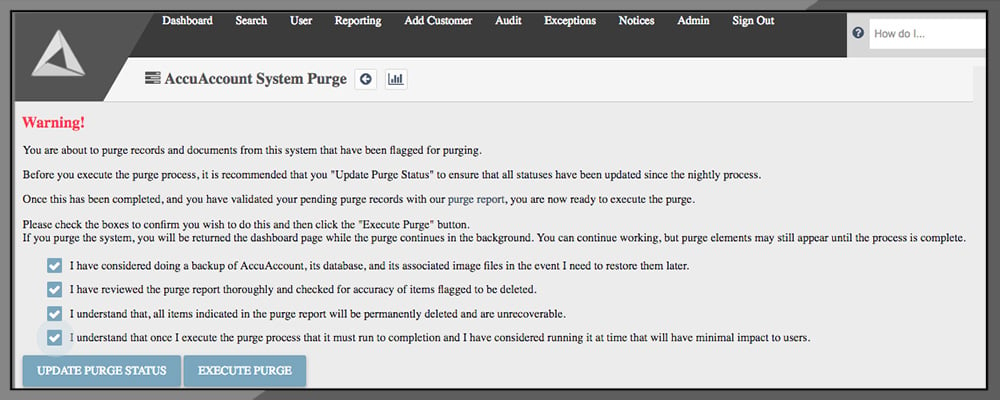

Ongoing document retention is also simplified thanks to AccuAccount’s “Purge” feature. AccuAccount allows your bank or credit union to define and manage retention rules for customers, accounts, collaterals, and specific documents in the system. In addition to manually purging records and documents, AccuAccount offers customizable “retention rules” based on date fields. As records reach the end of their retention periods, AccuAccount delivers a straightforward method for purging documents, accounts, and collateral (in compliance with your institution's retention schedule).

Important note: Nothing is purged automatically from AccuAccount. Our system tracks based on your defined retention schedule, but your institution makes the final decision to take action.

Important note: Nothing is purged automatically from AccuAccount. Our system tracks based on your defined retention schedule, but your institution makes the final decision to take action.

Efficient Document Retention

Spending all day down in the cellar isn’t a good use of your time. Before next month’s purge date rolls around, spend a few minutes watching the AccuAccount demo. The software will change your life for the better and give your bank or credit union the tools to enhance compliance and efficiency.

Contact us today for more information and to get started

Be the first to know! Click below to follow us on LinkedIn for news and content updates!