3 Loan Management Workflows to Help You Save Time & Drive Efficiency

Automating a single task may not seem like a big savings in the grand scheme of things. But, what if that task occurred multiple times per day and for multiple users? Over the course of several years, automating such a task could deliver a measurable impact.

At Alogent, we’re passionate about delivering process automation solutions for banks and credit unions. During a recent webinar, we discussed three time-saving workflows to enable with our AccuAccount software. Let’s explore how each workflow might benefit your financial institution.

Workflow #1: Automating Task Delegation

Relying on paper checklists, calendar reminders, and handwritten sticky notes isn’t a scalable method for ensuring success. Although there are a variety of productivity tools on the market, few are likely to integrate with your core banking system.

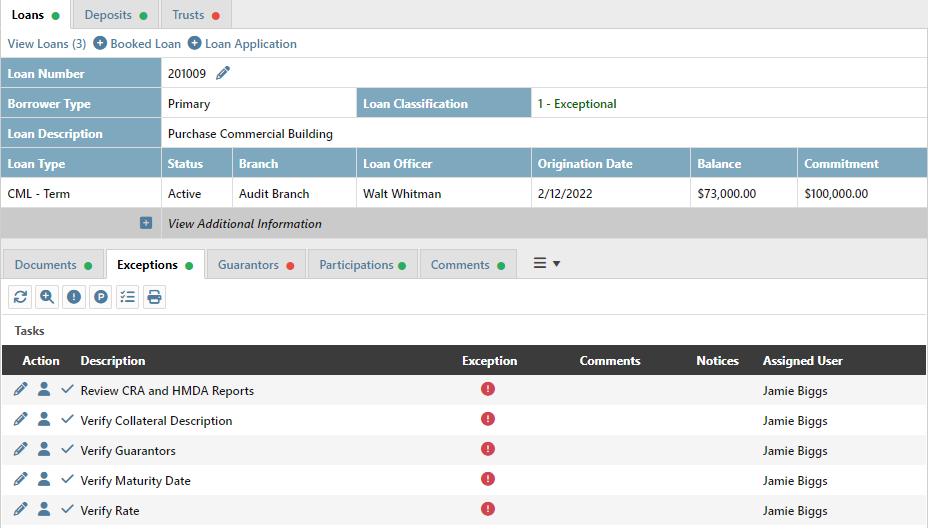

AccuAccount is designed specifically for financial institutions and offers numerous productivity enhancing features, such as task groups. Task groups make it easier to implement a predictable process for creating and assigning tasks. If your financial institution already uses AccuAccount to manage its credit and loan files, staff will appreciate having their exception data—including task exceptions—within a single experience. Team leaders will appreciate the ease of delegating without manually keying in every task.

Example: Let’s say that your post-closing review process includes ensuring guarantors are properly attached to the note, verifying that the collateral description is correct on the core, checking that the note’s maturity date and rate match the core, reviewing CRA and HMDA reports, and other important steps. Simply define all of these tasks ahead of time (as a task group) and then enable it on the appropriate customer page in AccuAccount. Tasks will appear automatically and can be assigned to specific team members. Staff can easily view and mark tasks as complete in AccuAccount.

What It Means: Reduced data entry, easier delegation, and better visibility for team members.

Workflow #2: Streamlining Commercial Loan Routing

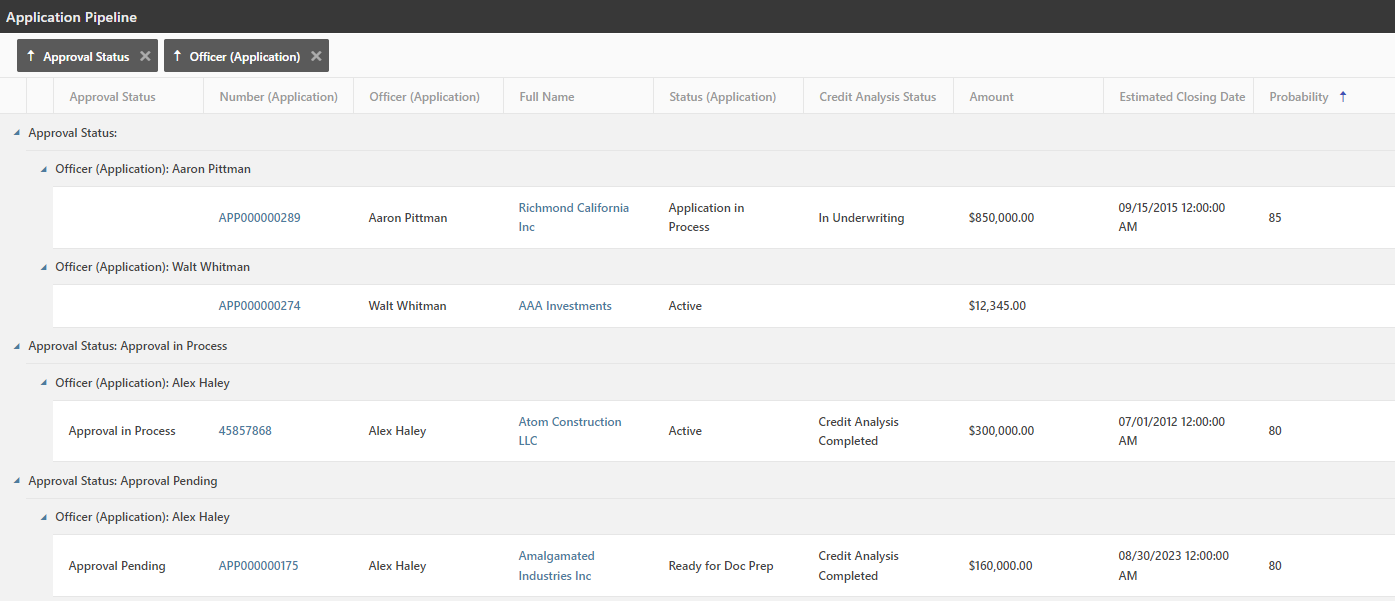

Compared to moving around paper loan files, utilizing a loan workflow solution like AccuApproval represents a huge opportunity to boost efficiency. For starters, AccuApproval can be customized to your lending workflow and tracks activity during the entire approval process. Routing the electronic loan file can be done with just a few clicks, and automated email notifications keep stakeholders in the loop. Pipeline reports and timers bring visibility to the approval process.

Example: Let’s imagine that a commercial customer requests a revolving line of credit, and your financial institution uses AccuApproval to manage the approval process. The initial documentation has been added to the correct tabs in AccuAccount, and the application is ready to be routed to an analyst group. Within moments, members of the analyst group will receive emails that contain a link to the application in AccuApproval. They can click the link, perform their analysis, and route the file to the next user or team. Failing to take action in a timely manner would result in an exception.

What It Means: Fewer delays, less paper to move around, improved accountability.

Workflow #3: Creating a Scalable Document QC Process

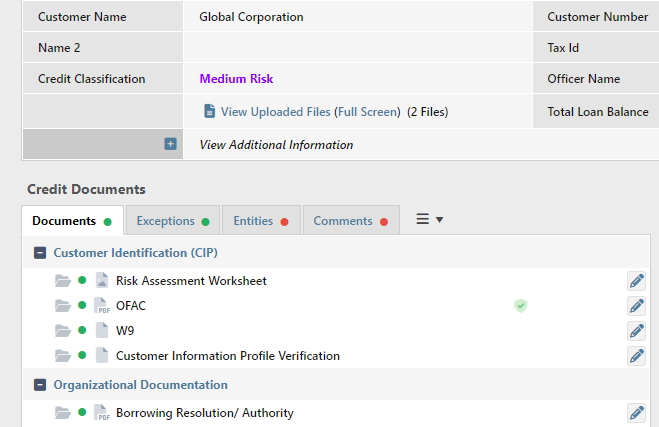

Merely scanning paper documents into a digital repository offers no guarantee of increased efficiency—especially if information is illegible or missing. That’s why we’ve built multiple safeguards into AccuAccount, including our document approval workflow. Administrators can define which, if any, documents should be considered “QC critical” in AccuAccount. In other words, they’re able to ensure certain documents undergo a quality control review before exceptions are cleared.

Example: Let’s assume that your financial institution requires OFAC (Office of Foreign Assets Control) documentation to go through a mandatory QC process. In this situation, you might create a document approval workflow for any new OFAC document that is added to AccuAccount. After an OFAC document has been reviewed and approved, AccuAccount will automatically remove the exception and display a green shield to indicate QC is complete.

What It Means: Less confusion, accurate exception data, enhanced quality control.

Explore Alogent’s Process Automation Solutions

Learn more about AccuAccount and Alogent’s process automation solutions. We’re happy to answer your questions or provide you with a demo of our software.

Contact us to start a conversation

Be the first to know! Click below to follow us on LinkedIn for news and content updates!