Document & Customer Management Platform, AccuAccount

It’s hard to service customers and members in times like these when all of their information and documents are in on-premise systems and paper file folders. AccuAccount, when implemented into a modern IT infrastructure, aligns with a bank or credit union’s remote workforce model that empowers lenders, back-office staff, and virtually anyone else to maintain business as usual. AccuAccount provides instant access to customer and account data, files, and reports, including credit and loan exceptions, deposit and trust records, and much more. More than 15,000 bankers trust our software to manage and track vital customer and account data in a highly scalable and intuitive ecosystem.

Software to Help Remote Teams

Serving Financial Institutions of All Sizes

At Alogent, we develop software that simplifies lending and loan administration. 15,000 bankers trust AccuAccount for core-integrated imaging, tracking, reporting, and audit and exam preparation. We’re not a subsidiary of one of the cores. Your needs are our primary focus, and we’re excited to help your financial institution leverage smart technology to scale your lending operations.

15,000+ TRUST

OUR SOFTWARE

Banks count on Alogent to electronically image loan, deposit, trust, and operational documents. Our platforms have been trusted by banks for over two decades for loan document imaging, deposit tracking, signature imaging, accounts payable management, and more. Alogent’ bank imaging software works seamlessly with your core system, providing an integrated way to scan, store, and manage digital bank documentation.

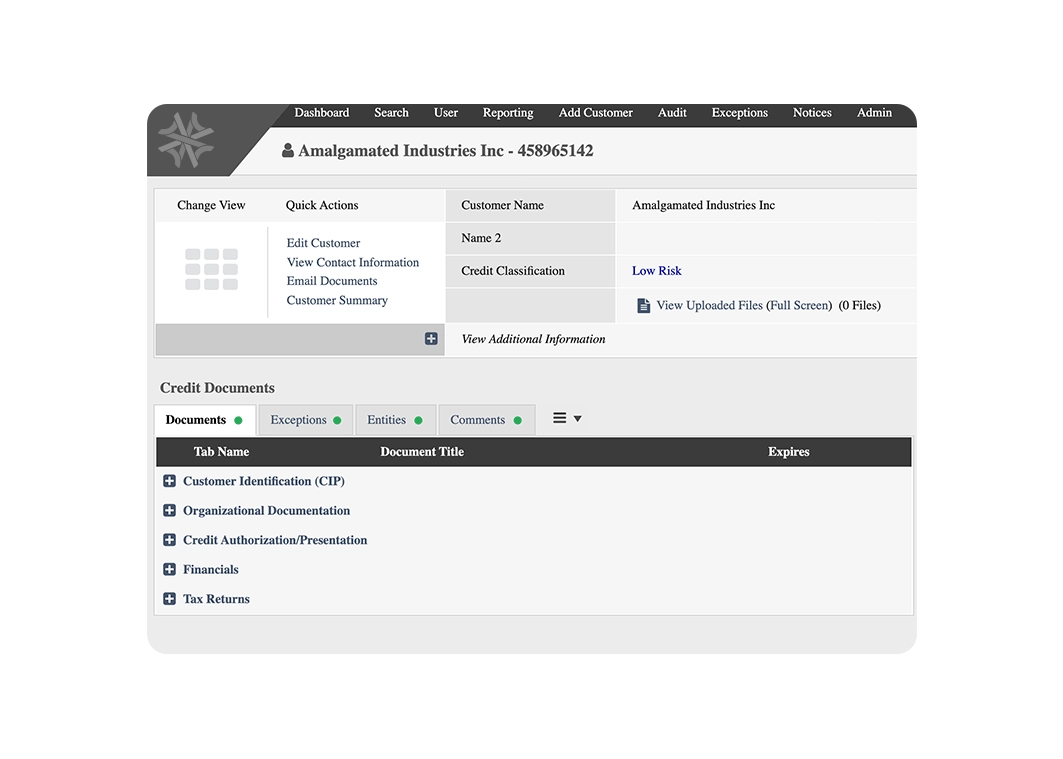

Data-Driven Customer and Member Management

Data is at the heart of today’s financial industry. If your team cannot access vital data, they cannot do their jobs. When they can’t do their jobs, your financial institution suffers.

Gain a competitive edge and enhance your continuity planning efforts with AccuAccount, our core-integrated document and customer management platform. Give lenders critical information to engage their customers. Keep back-office staff organized and better informed. Provide data-driven reports to senior management.

Register for a live demo of our software

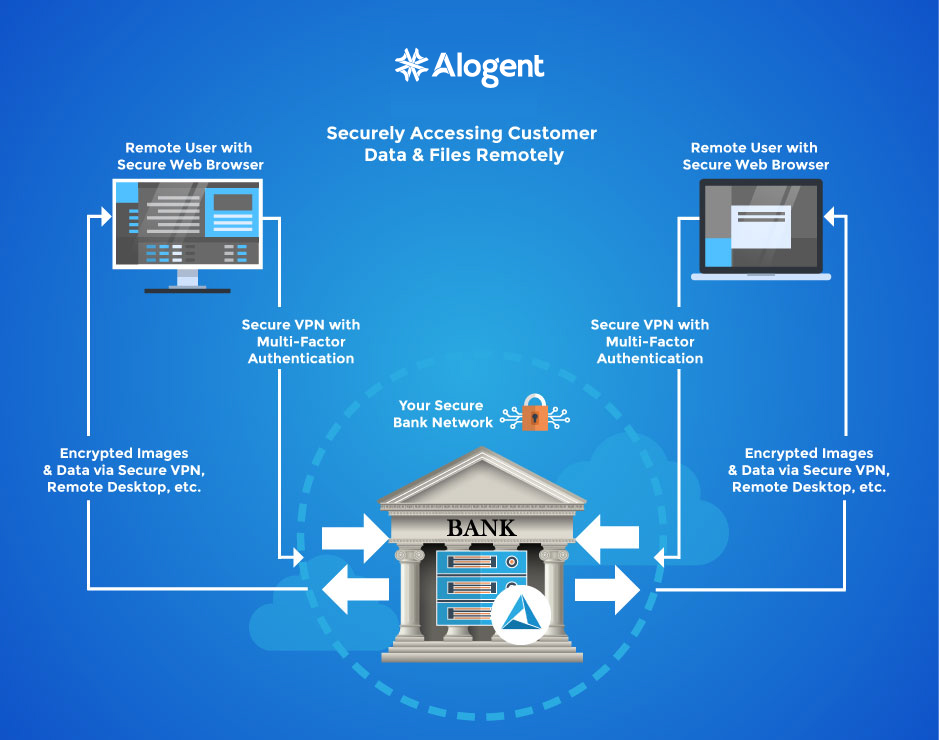

Enable Secure Access to Data & Files

Banks and credit unions across the country are using AccuAccount to enable secure remote access to customer data and files. Here’s how it works:

- AccuAccount is installed on your financial institution’s servers

- Fits seamlessly into your existing IT infrastructure & security

- No software installed on end-user devices

- Accessible to remote users via your bank or credit union’s secure VPN

- Fine-grained control of user-level access (view only, edit access, etc.)

- Audit logging and reporting of all documents viewed

- Trusted by IT managers at 300+ financial institutions and 15,000+ bankers

See Our Software in Action

Watch an on-demand demo of AccuAccount, our core-integrated document management system. Learn how to streamline bank imaging, simplify exception tracking, and accelerate audit and exam prep. See why 15,000+ bankers use AccuAccount.